Industrial Parks – Infrastructure Development in Vietnam – Spotlight on Investment Attraction in 2023

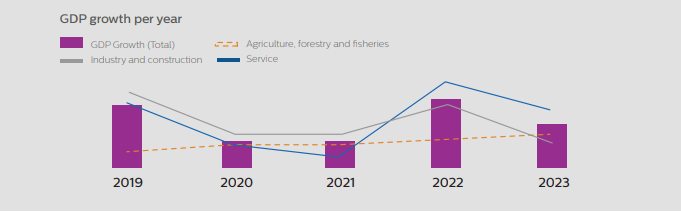

Vietnam’s economy is grappling with the uncertainties and recession in the global economy, particularly in the Industrial and Construction sectors. The GDP growth rate for the Industrial and Construction sector in 2023 is 3.74%, even lower than the GDP of Agriculture, forestry and fisheries (3.83%) and the lowest in the period from 2019 until now. This indicates a significant impact of the global economy on Vietnam’s Industrial and Construction sector in the past year. However, when examining the quarterly GDP growth figures for the Industrial and Construction sector, there is a steady upward trend throughout the year. In the fourth quarter, the sector’s GDP reached 7.35%, the highest among three sectors. Although this year, Vietnam’s overall economy and specifically the Industrial and Construction sector recorded a decrease compared to previous years, the situation is improving positively and expecting that it will continue to show higher figures in 2024. The forecast of Vietnam’s GDP in 2024 is expected to be 6 – 6.5%, according to the resolution of the National Assembly.

The overall Industrial Production Index (IIP) for December in Vietnam is estimated to increase by 5.8% compared to the same period in 2022, maintaining an upward trend in the fourth quarter of 2023 compared to the same period in 2022. However, when examining the IIP (MoM) comparision, after recorded an increase in October (up 5.5% compared to September), the subsequent months consistently reported decreasing growth rates (November increased by 3% and December increased by 0.1% compared to the previous month). This situation was previously forecasted due to a significant increase in new ỏders in August and September, leading to the IIP increase in October. However, as no new orders were recorded afterward, the IIP growth slowed down.

The United States remained Vietnam’s primary export market, with a value of 96.8 billion USD, representing an 11% decrease compared to 2022. On the import side, China remained Vietnam’s main importing market, with a value of 111.6 billion USD, decrease 5% compared to 2022. It can be observed that demand in major export markets of Vietnam has decreased significantly this year. The current economic situation in China, not recovering as expected, has led to a decline in both exports and imports of Vietnam in 2023. However, compared to the earlier months of the year, there are positive signs in trade activities (with the decrease of rate of growing show a tendency to reduce, especially in the case of exports gradually).

The Current Status Of Industrial Park Infrastructure Development

According to data collected by HOUSELINK, there are currently more than 400 operating industrial parks nationwide. Industrial parks are mainly distributed in the Northern and Southern regions, which have favorable geographical locations as well as attract many diverse occupations in all fields. Additionally, the Central region currently has the lowest number of industrial parks due to geographical challenges and difficulties in goods transportation.

According to our survey on the internal transportation infrastructure of industrial parks nationwide, the construction of some roads around the industrial parks currently meets the basic standards for designing internal transportation infrastructure within the industrial parks. Accordingly, the use of 4 main lanes and 2 auxiliary lanes predominates. Following that is the group of 2 main lanes and 2 auxiliary lanes. Other lane groups have a lower proportion.

At present, there are many types of road transportation systems constructed near or even traversing through industrial parks, such as highways, provincial roads, but mostly national highways. Next are the areas adjacent to provincial roads. Particularly, the ongoing improvement of the expressway system is leading to an increasing number of areas adjacent to expressways.

The Situation Of Investment Projects In Industrial Parks

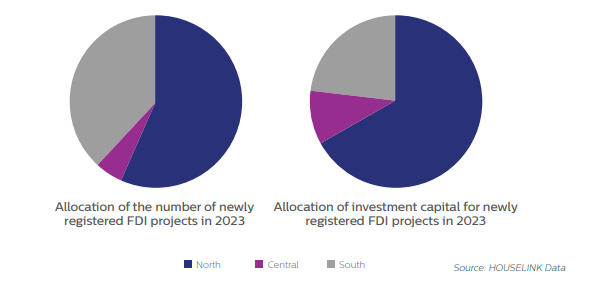

According to HOUSELINK data, in the last 6 months of 2023, Vietnam attracted approximately 483 newly registered FDI projects for investment in industrial parks, representing a 44% increase compared to the first 6 months of the year. Overall, in 2023, the country recorded a total of over 818 newly registered FDI projects for investment in Industrial Parks, showing a significant.

According to HOUSELINK data, while the proportion of warehouse rental projects in the total number of newly registered FDI projects has maintained an upward trend in previous stages, by the end of 2023, the proportion of warehouse rental projects tends to decrease compared to previous quarters. However, looking at the trend of warehouse rental projects in the quarters of 2022 and 2023, the decline seems to have appeared only in the fourth quarter of this year, with previous quarters still recording growth in warehouse rental projects. Warehouses remain one of the preferred types of industrial real estate, especially given the continuous increase in land lease prices in key provinces and cities. In 2023, the electronics industry takes the lead in warehouse rental projects.

In 2023, we observed that the electronics industry had the highest number of newly registered FDI projects. Particularly, it attracted significant attention and formed supply chain linkages in the Northern region. Electronics remains a focal point for investment in Vietnam over the past year. With the government’s strategy to attract high-tech industries, it is anticipated that the electronics sector will continue to be a major attraction in Vietnam in 2024, driven by the increasing demand for electronic products, especially components and assemblies. This is particularly relevant to technology-related products and electronic components serving industries such as renewable energy, medical equipment,… The Cam Dien – Luong Dien Industrial Park in Hai Duong has been the most attractive industrial park for numerous projects in 2023.

The new construction projects are the first-time investment of investors in Vietnam. Expansion projects include projects that are extended or constructed at different locations within the territory of Vietnam by existing investors. Accordingly, the number of new construction projects is greater in quantity compared to expansion projects (approximately 17% more). In terms of investment capital scale, however, expansion projects have a total registered investment amount higher by about 22% compared to new construction projects. Therefore, expansion projects have a higher average investment per project compared to new construction projects. Nevertheless, the differences between these two types of investors are not significant and Vietnam remains an attractive investment destination for both new and existing investors.

Please read more here! or click here!

Source: HOUSELINK