Investment Report – Supply Chain Logistics Industry In Vietnam 10M/2022

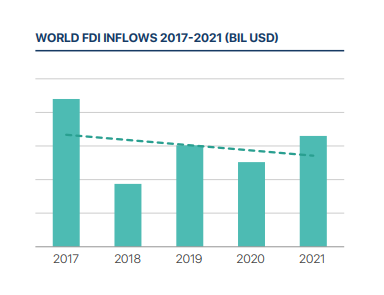

World FDI is on a downward trend from 2017 to 2021. Since 2017, the world FDI flows have changed continuously and there has never been a year that surpassed the number recorded in 2017. In 2021, global FDI flows recorded an increase of 30% compared to 2020 due to the controlled epidemic situation in many countries around the world.

However, entering 2022, global FDI is expected to be quite gloomy compared to 2021 due to investor uncertainty and risks from supply chain disruptions plus rising raw material costs and other risks from the global political and economic conflicts. This year, the global FDI is forecasted to be flat or down compared to 2021.

According to records in 2020, the global logistics market reached the largest scale in the Asia Pacific market with a nearby 4 trillion USD in market value. The Asia-Pacific region has long been an extremely exciting market for the logistics industry due to the concentration of many manufacturing plants, dense population, and high consumer demand. Next is North America and Europe region. In 2021, the global logistics market has recovered from the Covid-19 epidemic with a market size value of 9.53 billion USD (increased 17% compared to previous year). However, with the complicated developments of the macroeconomic situation and the inflation situation, the price of raw materials and fuels is forecasted to be still high in 2022, this market will also be significantly affected.

The Viet Nam economy in 2021 has suffered a severe decline due to the Covid-19 epidemic, by 2022, the economy is recovering. GDP in the third quarter increased by 13.67% over the same period in 2021. This Quarter 3’s GDP growth is the highest growth rate in a decade.

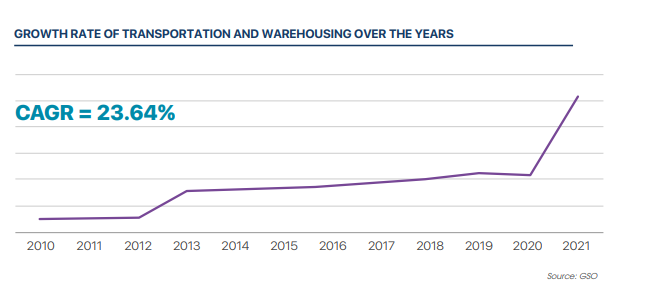

For transportation and warehousing services, the year 2021 was affected by the Covid epidemic and the policies of closing the borders of some countries, causing a negative growth in transportation and warehousing services. By 2022, the recorded number has improved since the beginning of the year until now, the growth rate of transportation and warehousing services is always positive and continuously increasing. This is a good sign for the economy in general and the transportation and warehousing industry which is gradually recovering after a period of severe impact from the epidemic.

In the first 9 months of 2022, Vietnam’s total import and export turnover reached more than 500 billion USD. Exports in the first 9 months of 2022 are estimated to increase by 17.3% and imports increased by 13% over the same period in 2021. The import-export in 9 months of 2022 reached a positive trade balance (surplus) exceeds 6.52 billion USD. In which, the domestic economic sector had a trade deficit of 22.89 billion USD, the foreign economic sector had a trade surplus of 29.41 billion USD. The foreign economic sector is still the area that accounts for the majority of Vietnam’s export markets.

The growth rate of warehouse transport in the period from 2010 to now has tended to increase rapidly, especially in recent years, the data we have collected shows strong growth. This shows that the logistics industry is making great progress, contributing greatly to the domestic economy. The Compound Annual Growth Rate (CAGR) in the period 2010-2021 reaches 23.64% (much higher than the growth rate of GDP of the country) and has shown a bright picture of the logistics industry in the Vietnam market. In the first 9 months of 2022, the growth rate of Vietnam’s transportation and warehousing industry increased by 14.2% over the same period in 2021, although in 2022, companies in the industry faces many difficulties with decreasing orders, costs are increasing, but with the explosion of e-commerce and efforts to stabilize the macro economy of countries in the world, it will help the logistics industry continue to achieve good growth in 2022 and also in the following years.

Status of the logistics industry in Viet Nam

“Investment in the Logistics industry tends to grow steadily over the years. FDI enterprises mostly focus on investing in warehousing and supporting activities for transportation. This is a rare investment industry that has steady growth, especially during the Covid-19 pandemic, this industry has achieved a very high number of registered investment capital. In 2022, while most other industries saw a significant decrease in both the number of projects and registered investment capital, the transportation and warehousing industry still achieved a relatively stable attractive number, this shows that this is still one of the industries with great potential for attracting investment in Vietnam”

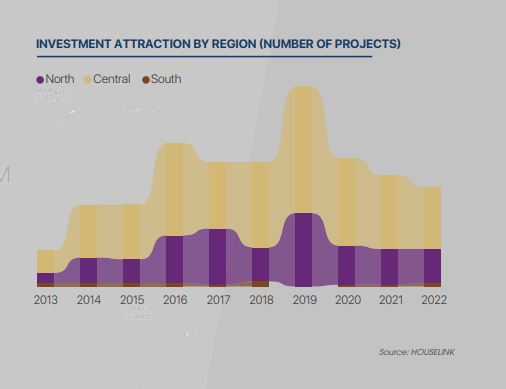

In terms of the number of Logistics projects attracting investment in Vietnam, we see a steady and clear growth trend from 2013 to 2019 (average growth rate of 37.3% in the period from 2013-2019) with a total of 658 projects. 2020 and 2021 are the periods of the global outbreak of the Covid-19 epidemic, so the number of projects attracted in these two years has decreased markedly. By October 2022, the number of newly registered projects in the transportation and warehousing industry was nearly 90% compared to 2021. But the world economic situation has not shown any signs of recovery, orders have been reduced, supply chain disruptions are still ongoing, and inflation is high. We believe that in the fourth quarter and the whole year of 2022, the investment attraction of the Logistics industry will achieve a good growth in the number of registered investment projects, but the increase will not be too large.

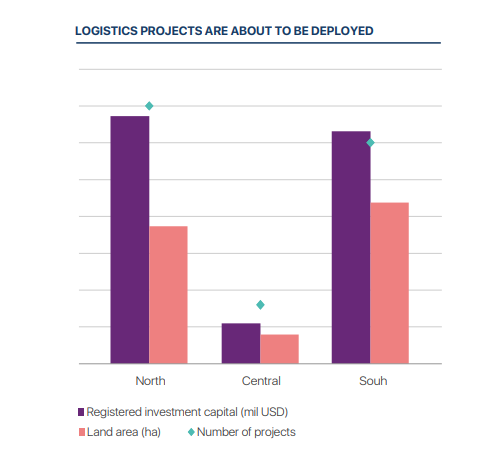

In the first 10 months of 2022, the Northern and Southern provinces attracted almost equal amounts of investment capital in the Logistics industry (50% and 46% of the investment capital accordingly), it can be seen that the scale of projects in the North is slightly higher. Central provinces account for only 4% of industry investment capital. In which, investment projects in the North are still mainly concentrated in the provinces of the Red River Delta economic region and in the South are concentrated in the Southeast economic region. These are also two regions with special development of various types of processing and manufacturing industries. Some provinces excel in attracting investment such as: Binh Duong, Long An, Bac Ninh, TP. Ho Chi Minh, Hai Phong, Bac Giang,.v.v.

“In recent years, Vietnam has begun to attract logistics projects from diversify investment capital sources” – HOUSELINK identify.

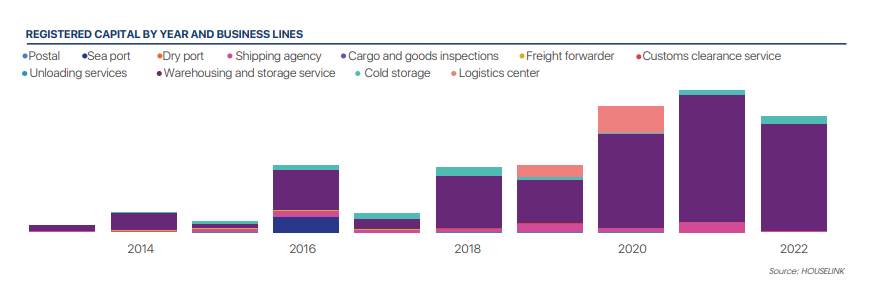

Logistics investment supply chain in Vietnam

Logistics is a specific business. Foreign direct investment (FDI) can only invest 100% in a few areas of the industry. Therefore, it can be clearly seen that FDI capital is focusing a lot on warehousing services and freight agency services. There are very few other services. Among them, freight agency service has the most registered investment projects and warehousing service is the field that attracts the largest amount of investment capital. The amount of investment capital in the field of warehousing always accounts for a large proportion of the fields of the Logistics industry (usually accounts for about 90% of the total investment capital) and tend to increase gradually over time. In which, cold storage is one of the niche markets with great potential for development in the future when cold storage investment projects appear continuously and the investment scale also tends to increase.

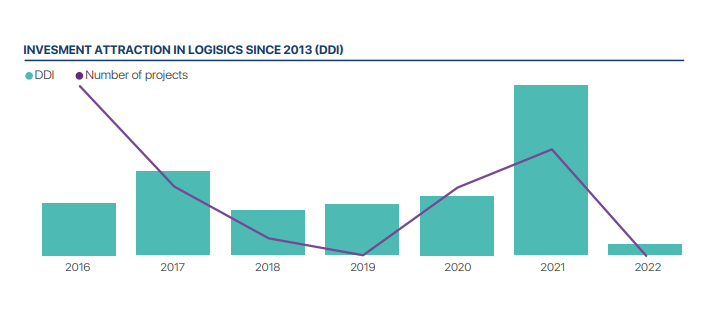

The situation of domestic direct capital investment (DDI) projects

DDI capital projects invested in the Logistics industry are tending to decrease in number of projects over the years. Projects that decrease rapidly from 2016 to 2019. The number of investment projects increased again at the time of Covid-19 epidemic (two years 2020 and 2021), this trend is similar to the trend of investment in FDI projects. The number of projects reached the highest level in 2016 but the amount of investment capital is not high because most of the projects to build warehouses and logistics centers are small-scale projects. The peak in the amount of investment attracted capital is in 2021 when the amount of capital attracted reaches nearly 500 million USD. The scale of projects in this period is also quite high (the average investment value of a project is about 50 million USD). The scale of projects in this period is also quite high (average investment value of a project is about 50 million USD).

Potential Logistics projects in the future

According to HOUSELINK’s data, potential projects are more concentrated in the North (accounting for about 48% of the number of projects about to be deployed). The number of projects about to be deployed in the South is not much less (41%) and only about 11% of the projects are about to be implemented in the Central region. The North and the South continue to be two exciting regions of Logistics projects in the future. Especially most of them are projects in the preparation and design stages.

This report is released in Vietnamese version, English version, and Chinese Version.