Summary Report -Supply chain investment of Pharmaceutical industry in Vietnam 2023

The world’s economic growth in 2023 is declining due to heavy pressures and risks from inflation, which, although decreased, but still remains at high levels and monetary policies continue to be consistently tightened. However, as for the world economy growing slowly, according to world economic experts, there is still a trend expected to unfold in the coming years. As 2024 forecast, GDP is expected to decrease slightly compared to this year – at a rate of 2.9% due to the global economy- especially in main countries and regions such as the United States and Europe, where significant improvements have not yet been evident. The strongest growth is expected to occur in the regions of emerging Asian economies.

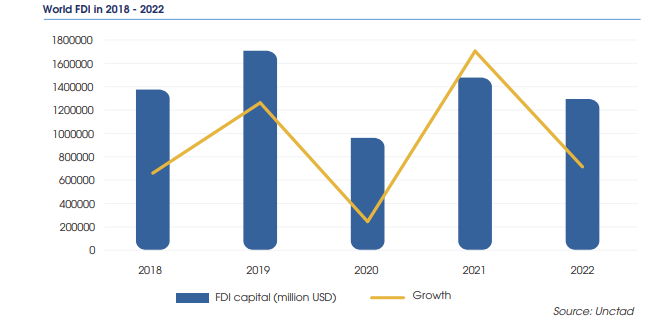

Global FDI flows in recent years have not been stable, having to undergo various crises that significantly impact the economy. In 2020, the global FDI was heavily affected as the Covid pandemic swept worldwide, resulting in a 44% decrease compared to 2019. Moving into 2021, the world entered a period of strong recovery with a substantial increase in FDI (up by 54%). But not for long, the global economy faced challenges such as the Russia-Ukraine conflict, soaring food prices and surge in debt, leading to a 12% decrease in global FDI. Additionally, industries grappling with supply chain challenges, including electronics, semiconductors, automobiles and machinery, witnessed an increase in project numbers, while investment in digital economy sectors slowed down.

The GDP growth rate for the third quarter of 2023 is only higher than 2020 and 2021 but is showing a positive trend (Q1 increased 3.32% compared to the same period, Q2 increased 4.14% compared to the same period, Q3 increased 5.33% compared to the same period). Meanwhile, the first, second and third quarters all show lower growth compared to the same period in 2022. Overall, the GDP for the first 9 months of 2023 has increased by 4.24% only surpassing the figures for the same period in 2020 and 2021.

In the first 11 months of 2023, the number of businesses registering for establishment as well as re-engaging in activities in the healthcare and social assistance sector has increased. However, there is a higher trend in the expiration of businesses and dissolution of businesses (30.1% and 31.8%, respectively). Nevertheless, the number of newly registered businesses is still significantly higher. It can be observed that the healthcare sector in Vietnam is currently on a trajectory of development and improvement. As a result, new business activities in the industry are increasingly recording higher growth figures.

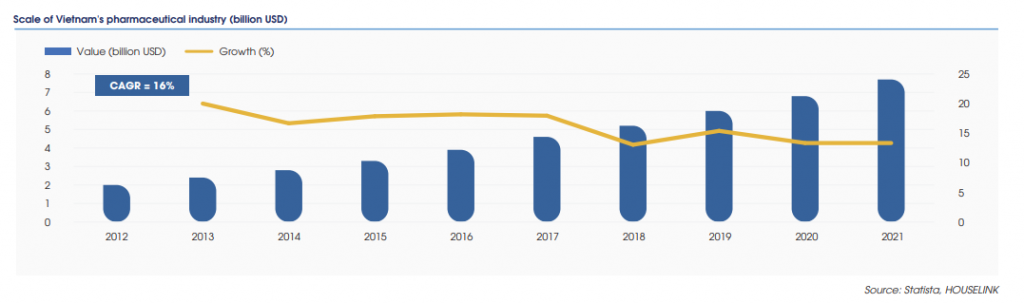

In the context of the global economic challenges faced by both the world in general and Vietnam in particular, the pharmaceutical industry in Vietnam is still gradually developing and showing a consistent growth trend over the years. From 2012 to 2021, the market growth in the pharmaceutical industry has consistently demonstrated optimism by maintaining positive growth rates. Overall, the scale of the pharmaceutical market in Vietnam continues to show a positive growth trend.

Based on the graph depicting the investment attraction in the pharmaceutical industry from 2013 to the present, the number of investment projects has shown growth over the years from 2013 to 2020. It peaked in 2020 and started gradually decreasing in the following years, especially in 2021 and 2022, when the Covid-19 pandemic erupted strongly, significantly affecting Vietnam as well as the global economic and political landscape. Vietnam recorded a sharp decline in both the number of projects and total investment compared to previous years. However, in 2023, the attraction of investment projects in the pharmaceutical sector has shown better growth. With a focus on attracting investment in the pharmaceutical-health sector as directed by the government, it is forecasted that in the coming years, projects in this industry will continue to experience growth in the Vietnamese market.

The majority of pharmaceutical projects in Vietnam are projects focused on the production of medical supplies and medical equipment, constituting a significant market share in terms of both the number of projects and the total investment amount. The production of drugs this year has seen an increase, although the rate of increase is not exceptionally high, but it continues to maintain a stable growth rate, excluding the general decline in the past two years due to the covid-19 pandemic. Most of the projects involved in producing medical supplies, medical equipment, and drug manufacturing projects concentrate on a large scale in the Southern region.

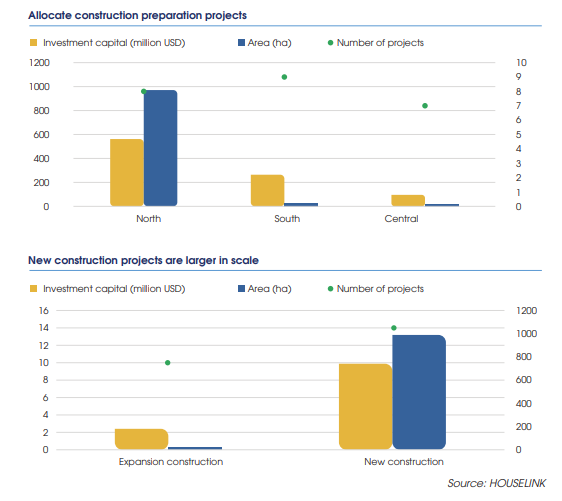

The projects preparing for construction deployment in the Southern region have the largest number of projects across all 3 regions, but in terms of total investment, the Northern region has a larger scale. Based on the data collected from HOUSELINK, we observe that new construction projects have a superior scale compared to expansion projects. This indicates the confidence of new investors in projects. This indicates the confidence of new investors in participating in production and the potential for the development of the Pharmaceutical industry in Vietnam.

Source: HOUSELINK