Summary Report – Supply Chain Investment of Plastic-Rubber industry in Vietnam November 2023

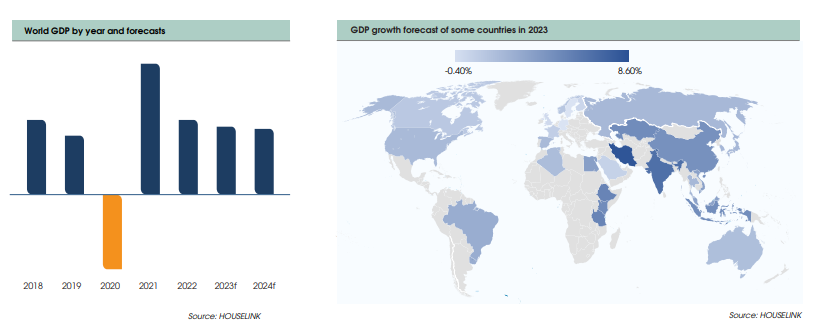

As the year comes to an end, in 2023 the global economic situation is projected to achieve a GDP growth rate of around 3%, a decrease compared to the 3.3% recorded in 2022. The global economic growth in 2023 is declining due to the pressure and risks posed by inflation, which, although decreasing, remains at a high level, and monetary policies remain tightened. However, despite the slowdown in global economic growth, according to experts in the global economy, there is still a tendency for growth in the coming years. The forecast for 2024 anticipates a slight decrease in GDP compared to this year, reaching 2.9%, as the global economy, especially in key countries and regions such as the United States and Europe, has not shown significant improvement. The strongest growth is expected to occur primarily in the regions of emerging economies in Asia.

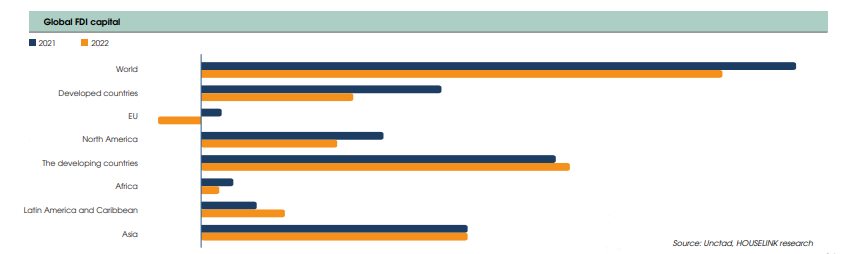

Global FDI inflows in 2022 decreased by 12% compared to 2021. This decline mainly occurred in developed economies, where FDI inflows decreased by 37% compared to 2021. However, FDI in developing countries recorded a 4% increase in 2022 compared to 2021, primarily concentrated in the East Asia and Southeast Asia regions. FDI inflows into developing countries show a stable growth trend compared to other regions.

The GDP growth rate for the third quarter of 2023 is only higher than that of 2020 and 2021 but shows a positive trend (1st quarter: 3.32% YoY, 2nd quarter: 4.14% YoY, 3rd quarter: 5.33% YoY). Meanwhile, the first, second, and third quarters are all lower compared to the same periods in 2022. Overall, the GDP for the first nine months of 2023 increased by 4.24%, only surpassing the figures for the same period in 2020 and 2021 (which were 2.12% and 1.42%, respectively). Globally, consumer demand remains low, protective trade barriers are increasing, many countries are maintaining tight monetary policies, and there are still high risks in financial and real estate markets.

The number of investment projects in the plastic-rubber industry has continuously increased but experienced a decline during the Covid-19 pandemic. Up to now, there have been signs of growth recovering, both in terms of the number of projects and registered capital.

FDI capital dominates the investment market in the plastic rubber industry in Vietnam, both in terms of the number of projects and the total investment amount. However, it can be noted that large-scale DDI projects in the industry have begun to appear more consistently since 2018 to the present. Unlike FDI capital, we observe that DDI capital projects have shown signs of recovery after the pandemic, but it is not yet clear. Domestic enterprises in the industry still face many challenges and high competition.

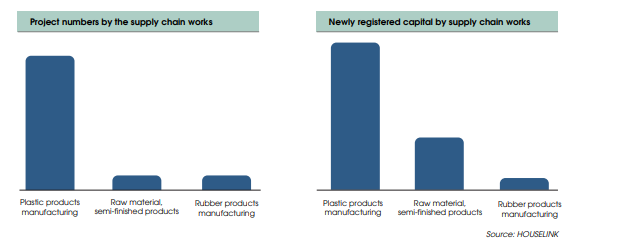

The supply chain investment is heavily oriented towards the production of plastic products

The majority of investment projects in Vietnam are projects producing plastic products, accounting for a large market share in terms of both the number of projects and the total investment. Although rubber product manufacturing projects have a nearly equal share in the number of projects compared to projects producing raw materials and finished products, the scale of investment is somewhat higher. Despite this, based on our observation, the growth rate in the number of projects for raw material and finished product manufacturing and rubber product manufacturing has been high in the past two years. Projects producing plastic products this year have shown some growth, although the rate of increase is not as significant, yet it consistently maintains a stable growth rate, excluding the general decline during the two years of the Covid-19 pandemic. The majority of projects producing rubber products and raw materials-finished products are concentrated on a larger scale in the Southern region, while projects producing plastic products are more concentrated in the Northern region.