Seven Top Tools For Managing Your Investments

Diversification, diversification, diversification. Money managers, financial advisors, and personal finance bloggers all consistently harp on the need to have a range of investments in different asset classes to both increase yield and mitigate risk.

But, with so many different investments, it can be hard to manage and track them all.

Here are seven online tools to help you monitor your investments, as well as research new opportunities and portfolio strategies.

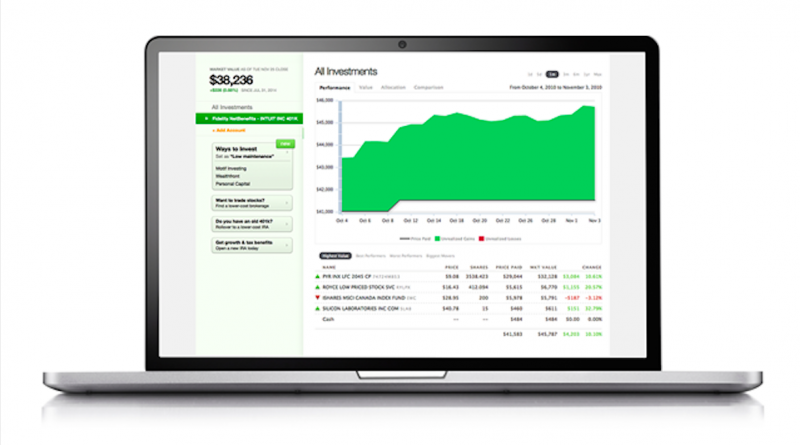

Personal Capital

Personal Capital is a one-stop shop for analyzing your complete portfolio and spending. The company has bank-grade security and allows you to connect accounts from over 12,000 financial institutions in seconds.

Once your accounts have been loaded, Personal Capital’s software will perform a total analysis, reviewing your portfolio to see if there are any glaring concerns or simple optimizations that can be made.

Most commonly, Personal Capital can help you avoid paying high hidden fees. Maybe the expense ratio is higher on your IRA than it is on a similar investment with higher returns or maybe the fees on your REIT holdings are above where they could be. Personal Capital will identify patterns and suggest changes to help you increase your ROI.

SigFig

Similar to Personal Capital, SigFig will monitor your portfolio and make recommendations. Typically they suggest ways to reduce your tax liability, reinvest dividends, and can even automatically rebalance your portfolio to align with your desired asset allocation.

Anyone can start using SigFig with $2,000 and you won’t pay a fee until your portfolio reaches $10,000, when fees move to 0.25%—much lower than a traditional investment manager. SigFig claims that on average its software allows them to add 3.8% in returns to the portfolio of their standard investor.

Morningstar

Anyone researching a particular investment is probably familiar with Morningstar. Until a few years ago Morningstar reviewed only mutual funds, but they’ve now added individual stocks to the mix.

Investment research can be a time consuming process depending on the level of detail you’re looking for. Morningstar attempts to simplify the task by doing a lot of the legwork for you. In particular, their stock and mutual fund screener allows you to find investments according to tens of different data points.

Google Finance

If you don’t feel like spending to track and research investments then Google Finance might be the tool for you. As with most of Google’s resources, Google Finance is free, although it might be a bit bare bones for some investors.

One innovative section of Google Finance is Google Domestic Trends, which tracks search engine traffic within different sectors to spot potential insights into economic conditions.

Mint.com

Mint.com is the all-in-one financial tracking platform, giving you a holistic view of your investments, credit card spending, and everything in between. Mint.com categorizes purchases and then creates a budget for you based on historical spending.

As an investor you can track all of your asset classes and compare returns against industry benchmarks. However, unlike Personal Capital or SigFig, you will have to identify any changes needed on your own as Mint will not make suggestions.

Our friends at InvestorJunkie discovered the Mint Manual, a guide with tips and tricks to best make use of Mint.

Quicken

Quicken has been in the investment management software space the longest—decades longer than the newer cloud-based platforms.

Quicken 2015 Premier has partnered with Morningstar to create the “Portfolio X-Ray,” which allows you to see how you might be over or under-allocated in a specific asset class. Like with Personal Capital, you can also view a breakdown of the different fees that you’re paying for all of your holdings.

LearnVest

If you are in the market for a simple budgeting tool, LearnVest is comparable to Mint.com. LearnVest lets you link up all of your bank accounts and creates a budget based on your typical spending habits.

However, LearnVest lacks the level of investment reporting that tools like Personal Capital, Quicken, and SigFig provide. Financial planning is available for an additional monthly fee.

Image source: saveinvestgrow.com