Market Insights #1: Rapid growth in Vietnam Industrial land leasing rate

(HOUSELINK) – According to Vietnam Industrial Real Estate Report on 3rd Quarter 2020, Vietnam is expected to be a destination for multinational enterprises, to grab the wave of production shifting, investors have been accelerating the construction of infrastructure, as well as industrial real estate products.

The COVID-19 outbreak in China since the end of 2019 has disrupted the supply chain, exacerbated the Sino – US trade tension, as well as the fast – paced change in relations among countries has speed up the shifting of production out of China.

With the expectation that Vietnam will be a destination for multinational enterprises, to grab the wave of production shifting, investors have been accelerating the construction of infrastructure, as well as industrial real estate products. While residential, commercial and tourism real estate have been severely affected by the COVID-19 pandemic, only industrial real estate has thriving potential in upcoming periods. Hence enterprises have been moved business onto industrial real estate, silently preparing infrastructure. The key “new players” must be mentioned as follows

Enormous number of new investment activities lead to shortage in land supply for the development of new industrial parks. In combination with the prospect that demand will spike after the COVID-19 pandemic is controlled, industrial real estate developers have simultaneously increased land leasing rates. HOUSELINK’s survey shows that industrial land leasing rate have been increasing by at least 10% compared to the previous quarter. Although the actual number of successful transactions in the third quarter is humble. It shows that the growth in industrial land leasing rate is not originated from the real supply – demand condition, but from the suppliers’ expectation.

However, the real demand in the upcoming periods, after the COVID-19 pandemic is under control, may not be as positive as expected. In the wave of production shifting out of China, not only Vietnam but also India and other countries in Southeast Asia (Indonesia, Thailand, Malaysia, etc.) have implemented drastic policies to attract FDI firms from moving out of China.

Vietnam expected to become a new production base for Apple’s new iPhone. However, the fact that India is the place that the giant carries out the assembly process of iPhone 11. It shows that in addition to the factors of political stability, geographical conditions in adjacent to electronic supply chain; Vietnam needs to develop its infrastructure, as well as create special mechanisms to attract large

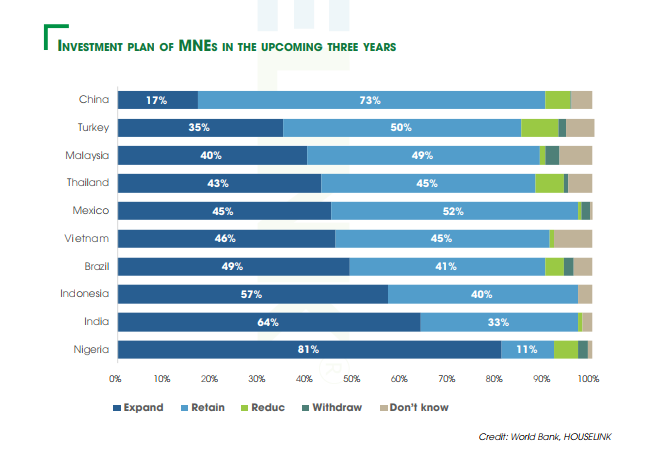

investors. Besides, manufacturers cannot move their entire production line out of China in the short-term. According to a survey conducted by the World Bank about investment plan in the next three years (2019 – 2022), up to 73% manufacturing firms in China responded that they would continue production there, and only 5% of respondents will reduce their investment size. It means that the production expansion plans to India and Southeast Asia are executed for the aim of diversifying production, minimizing business risks as well as reducing incremental pressure from Sino – US trade tension.

In the medium term, the supply of industrial real estate may witness a dramatic growth. Meanwhile, demand fluctuates and face with extremely geopolitical tension. While industrial real estate development follows a trend, investors have not conducted a thorough research and equipped deep understanding about this segment. It causes difficulties during business development process. In the past, industrial parks were not regularly active in finding manufacturing investors. However, while the supply exceeds the actual demand, the industrial parks have to put into a sore-throat competition to attract foreign investors. It will directly affect the land leasing price, as well as the profitability of industrial parks in the long term.

*The content is included in the 3rd Quarter 2020 | Vienam Industrial Real Estate Report by HOUSELINK.

This Report will be sent to more than 50.000 manufacturers from Korea, Japan, China, Taiwan, Hongkong. Grab a chance to attract more potential clients through our network here.

2nd Quarter 2020 | Vienam Industrial Real Estate Report

Read more Reports by HOUSELINK here.

About us:

HOUSELINK is a consultant agency in construction industry. We provide a range of services to bring better insights about Vietnam construction industry. Basing on HOUSELINK Market Intelligence & Ebidding platform, our Market Reseach team publish In-depth Research, Analysis and Forecasting Reports as well as Periodical Reports, Weekly Newsletters, Topical Analysis and Market News and Updates on our blog VietnamConstruction.vn.

Contact for more details of our Solutions (link) or:

- Ms.Hằng Nguyễn– Senior Business Analytics Consultant

- Email: hangnguyen@houselink.com.vn

- Phone: (+84) 936 378 991