Report of Vietnam Industrial Park Infrastructure Development Report – Current situation and development prospects H1.2023

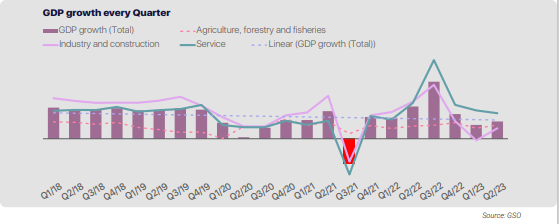

In 2023, it is forecasted to be difficult to achieve high growth rates like in 2022. The projected GDP growth rate for Vietnam in 2023 is expected to be between 5.34% and 6.46%. From the first quarter of 2023, GDP growth has experienced a decline compared to the first quarter of previous years (achieving 3.32% compared to 5.03% in the first quarter of 2022). In the second quarter of this year, GDP growth recorded a rate of 4.14%, only higher than the second quarter of 2020 (0.36%), but better than the first quarter in most sectors. Overall, in the first six months of 2023, GDP growth reached 3.7% compared to the same period.

The PMI index has consecutively recorded below 50 points since March until the present, indicating that business conditions continue to deteriorate, primarily due to weak demand. On the other hand, Vietnam’s IIP index has improved since February 2023. The peak was 9.6% in March. The manufacturing sector, in general, still shows a higher IIP growth compared to other sectors and shows signs of improvement.

Vietnam’s merchandise trade balance for the first six months of 2023 achieved a surplus of 12.25 billion USD (compared to a surplus of 1.2 billion USD in the same period last year). However, both exports and imports decreased compared to the same period. Specifically, Vietnam’s export value reached 164.45 billion USD (12.1% decrease compared to the same period) and import value reached 152.2 billion USD (18.2% decrease). The foreign economic sector still accounted for a sizable proportion of both export and import turnover (73.6% and 65% respectively). The United States remained the largest export market for Vietnam (44.2 billion USD). Regarding imports, China remained Vietnam’s largest import market (50.1 billion USD). The decline in major export markets such as the EU and the United States, or the slow recovery of the Chinese market as expected, along with competition from China in exports, has led to a decline in production and exports for Vietnam.

Some Factors Directly Affecting Investment Attraction in Industrial Parks

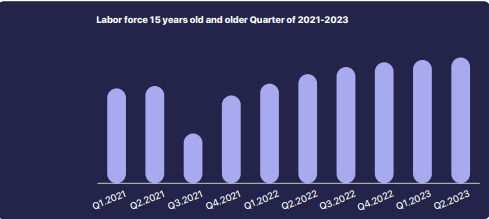

The labor force aged 15 and above in the second quarter of 2023 reached 52.3 million people, a slight increase of 0.2% compared to the first quarter of 2023. The labor supply remains stable. However, in terms of labor allocation across economic sectors, we have observed a shift in labor from the industrial and construction sectors to the services sector (the industrial and construction sectors decreased by 1.2% in labor force, while the services sector increased by 1.5%). The continuous decline in orders has affected labor in the industrial and construction sectors. The average income of workers in the second quarter of 2023 slightly decreased compared to the first quarter of 2023, and the income of workers in the industrial and construction sectors also experienced a decline compared to the first quarter (a decrease of 1%). Compared to other countries in the ASEAN region, the average wage of workers in Vietnam is still relatively low.

In replacement of Decree No.82/2018/ND-CP on the management of industrial zones and economic zones, Decree No. 35/2022/ND-CP regarding the management of industrial zones and economic zones officially came into effect on July 15, 2022. This new decree is expected to improve the investment and business environment, streamline administrative procedures for businesses, and provide certain benefits.

Current Status of Industrial Zone Infrastructure Development

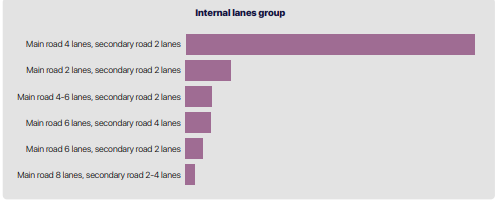

According to our survey on the internal transportation infrastructure of industrial zones nationwide, the construction of certain roads around the industrial zones currently meets the basic standards for the design of internal transportation infrastructure within the industrial parks. As per the survey, the use of four-lane main roads and two-lane secondary roads is predominant. Following are main roads with two lanes and secondary roads with two lanes. Other road groups have a lower proportion.

Currently, there are numerous types of road transportation built near or even traversing through industrial parks, including expressways, provincial highways and predominantly national highways. Additionally, there are areas adjacent to provincial highways. Particularly, with the emphasis on completing the highway system, the number of areas adjacent to expressways is increasing day by day.

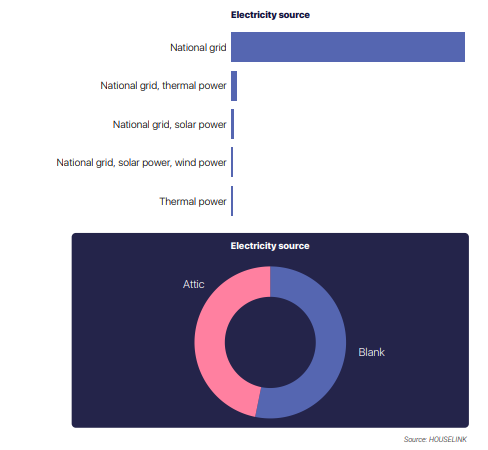

Most industrial parks primarily rely on the national power grid as their source of electricity. Among them, some industrial parks combine the national power grid with other renewable energy sources such as solar and wind power. However, the number of such as solar and wind power. However, the number of such cases is currently limited. Nevertheless, according to our records, over 46% of industrial parks nationwide have rooftop solar power installations. It is evident that investors are increasingly emphasizing the use of renewable energy to replace traditional power sources in order to ensure green production standards. This is also one of the factors influencing exports to markets with high requirements and taxation for non-green, non-clean production, such as the United States, the European Union and others. Solar panel manufacturers and suppliers have also been increasing their production to meet the demand from investors. In order to reduce carbon emissions as part of Vietnam’s commitments at COP26 and enhance competitiveness for industrial parks in attracting sustainable investors, it is crucial for industrial parks to have a serious and systematic approach in utilizing renewable energy sources.

Social amenities such as fire protection and prevention, hospitals, supermarkets, customs and schools have significantly improved. Some industrial parks have constructed and established these infrastructure facilities within their premises. Other industrial parks are also conveniently located with proximity to these social amenities. This helps industrial parks in attracting labor force and ensuring the daily living standards of the workforce.

Nationwide, the occupancy rates of industrial parks are relatively high. Many industrial parks have an average occupancy rate of over 90%. Industrial parks with available warehouse space for lease constitute a significant proportion. On the other hand, industrial parks with pre-built factories for lease are relatively scarce. However, there has been an increasing trend in demand for industrial projects that offer pre-built factories for lease in recent years. Therefore, industrial parks need to diversify their real estate offerings to enhance attractiveness and meet the practical needs of investors.

In terms of land rental prices, across the country, most industrial parks still have rental prices mainly in three price ranges: <=50 USD/m2/lease cycle. 50-70 USD/m2/lease cycle and 70-90 USD/m2/lease cycle. However, compared to the end of 2022, the proportion of industrial parks with these price ranges is showing a downward trend. Instead, there is an increase in the price ranges of 90-110 USD/m2/lease cycle and 150-200 USD/m2/lease cycle. For high prices >200 USD/m2/lease cycle, we have observed a slight decrease in the proportion of industrial parks applying this price range.

Most ready-built factory rentals are priced in the range of 3-5 USD/m2/month (over 50% of industrial parks have this rental price range for factory units). The rental prices for ready-built factories have not shown significant differences compared to the end of 2022. There is not much fluctuation in rental prices for ready-built factory units.

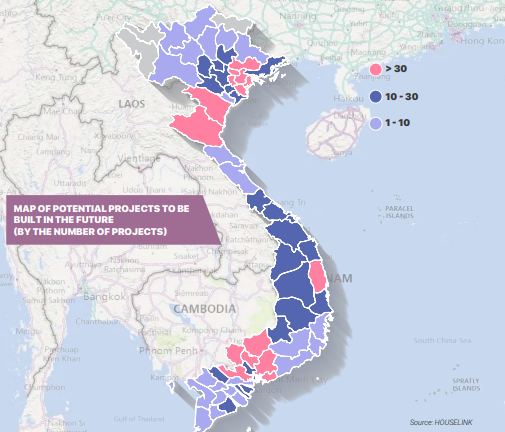

In this section, we focus on analyzing the new industrial parks with investment policies, investment certificates and 1/2000, 1/500 planning in the first 6 months of 2023 (expanded industrial parks are considered as new industrial parks). According to the data from HOUSELINK, as of the first 6 months of 2023, many new industrial parks were added in the northern region. The difference in future supply between the central and southern regions is relatively small. It can be observed that the future supply of new industrial real estate in the northern region is abundant, capable of meeting the increasing investment demand in this area.

Status of investment projects in industrial parks

According to data from HOUSELINK, in the first half of 2023, there were a total of over 377 newly registered FDI projects registered for investment in industrial parks nationwide, reflecting a significant increase in the number of projects compared to the same period last year (an increase of 53% compared to the same period in 2022). The total attracted investment capital also experienced strong growth, with a 46% increase compared to the same period in 2022.

The majority of the newly registered FDI projects in the first six months of 2023 have been attracted to the northern provinces, especially projects with large investments, which have given the northern region a significant advantage over the other two regions. In particular, the first quarter of the year witnessed a high influx of investment in the northern region, with several projects exceeding 100 million USD in investment capital.

Source: HOUSELINK