Implementation Report of Industrial Projects in Vietnam Quarter 2/2023

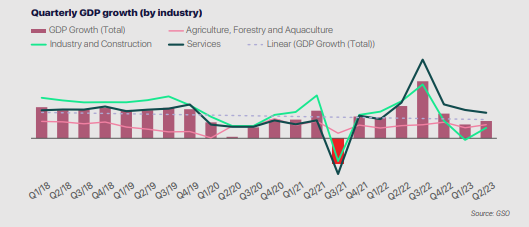

The GDP growth rate in both the first and second quarters of 2023 was lower compared to the same period in 2022. This was anticipated fact due to the challenges from the ongoing global economic situation, which has been affecting Vietnam’s macroeconomic conditions. However, the GDP in the second quarter showed signs of recovery compared to the first quarter, indicating a positive outlook for Vietnam’s economic growth by the end of this year. According to scenario No.01 of the Misnistry of Planning and Investment, the GDP forecast for the entire year 2023 is slightly lower than the set target (6% instead of 6.5%).

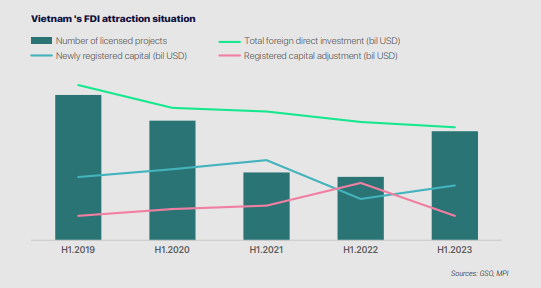

In the first 6 months of 2023, Vietnam had 1293 licensed projects, a 72% increase compared to the same period in 2022. Despite the decline in GDP in H1 2023, attracting FDI projects signaled a more positive development for the overall Vietnamese economy and investment climate. However, the total foreign investment capital recorded in the first half of this year showed a slight decrease (4%) compared to the same period last year. This decline is mainly caused by a 57% reduction in registered capital adjustments, while new registered capital increased by 33%. This indicates that new investors have great confidence in Vietnam’s investment environment and choose Vietnam as their destination. Meanwhile, existing investors tend to be more cautious in expanding production.

Status Of Newly Registered Industrial Construction Projects In H1.2023

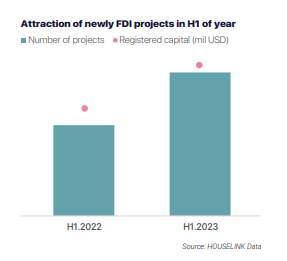

The number of newly registered projects and the capital amount in the first 6 months of 2023 experienced significant growth compared to the first 6 months of 2022. It showed that the Vietnam market is showing remarkable potential and strong appeal to foreign investors.

The number of newly registered FDI projects continues to be concentrated in the Northern region. In terms of total investment capital, we observed that the Northern region attracts many large-scale projects, followed by the Southern and Central provinces. The Northern provinces remain a vibrant market in the industrial sector.

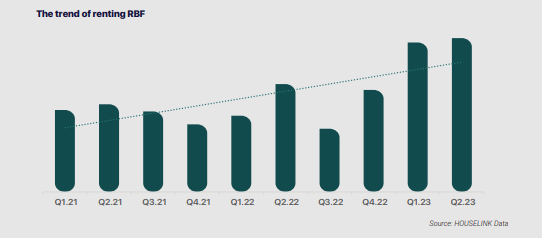

In the first 6 months of 2023, the number of ready-built factor (RBF) projects accounted for a higher proportion compared to the number of land lease projects. The percentage of RBF lease projects increased significantly compared to the same period in 2022, and the proportion of RBF lease projects among the total number of newly registered projects in the first 6 months of 2023 also increased compared to the similar period in 2022.

Through the quarter from 2021 to 2023, we have noticed a clear growth trend in RBF lease projects. Specifically, in the first and second quarters of 2023, the number of RBF lease projects has surpassed the number of land lease projects. However, in terms of investment capital, land lease projects still have a higher total registered investment capital.

In the top 10 industries attracting investment projects in the first 6 months of 2023, the electronics industry was the most attractive during this period, with a focus mainly in the Northern region. In the past two years, the government’s policies in attracting investments, along with strict criteria for selecting investment projects in terms of both quality and quantity, have resulted in minimal changes in the industries attracting investment.

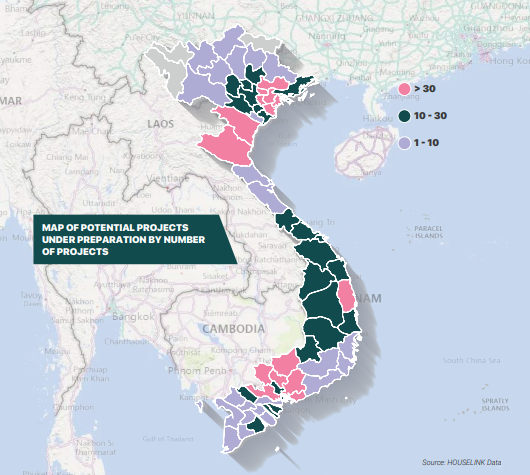

The HOUSELINK data shows that the number of projects currently under construction is mainly concentrated in the Northern region. This region is also home to many large investment projects is the country. The Central region has the least number of projects among the three regions. However, the Central region is characterized by being the investment destination for many energy projects, which has led to the highest investment capital scale for projects in this region among the three regions.

Agriculture and food industry will be the sectors with the highest number of industrial construction investment projects in the future, mainly concentrated in the Central and Southern provinces. The industry structure of the remaining projects under preparation for construction shows no significant difference compared to the first quarter of 2023. Each region continues to have its own characteristic investment sectors, aligned with their development direction and advantages.

Logistics is currently leading in the number of projects under construction. While the Northern region focuses on many electronics projects, in the Southern region, logistics is the characteristic project type. It is essential to note that within the logistics industry according to the HOUSELINK system, it includes both the construction of factories and warehouses for lease. In the future, the supply of both factories and warehouses will be added significantly to the industrial real estate market, creating more attractive factors in terms of supply for investors.