Report Of Industrial Park Infrastructure Development In Vietnam And Key Investment Attraction – First 5 Months Of 2024

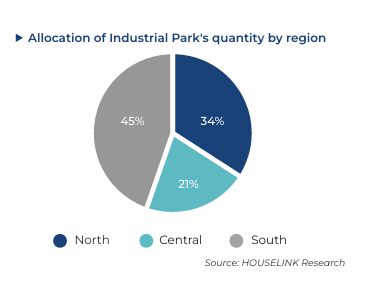

“Currently, there are approximately 429 operating Industrial parks in Vietnam with a total planned industrial land area of about 142,162 hectares, distributed across various regions with the majority concentrated in the Northern and Southern areas.”

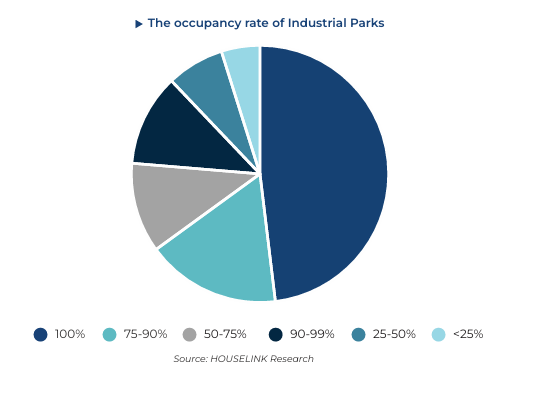

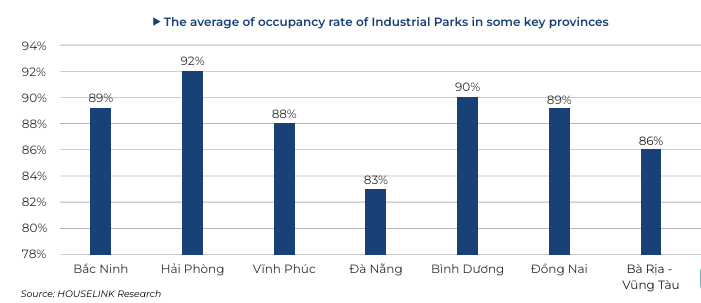

Based on a survey of 267 operating Industrial parks, the average occupancy rate of Industrial parks nationwide is about 80%. Of these, 48% are fully occupied, 28% have an occupancy rate above 75%, and 24% have an occupancy rate below 75%.

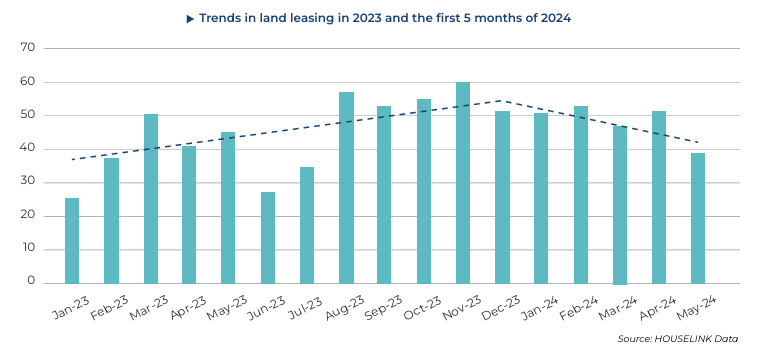

Based on HOUSELINK system data as of the end of May 2024, the absorption rate of industrial land showed a decreasing trend during April and May compared to the early months of the year. In the first three months of 2024, the growth rate of absorbed industrial land increased by more than 70% compared to the same period the previous year, with a significant surge in January. However, by April and May, the absorption rate of industrial land began to decline. Notably, in May 2024, the absorbed industrial land area was about 124.4 hectares, a 55% decrease compared to May 2023. Nonetheless, the overall land absorption for the first five months of 2024 showed considerable growth compared to the same period in 2023. Cumulatively, from January to May, the absorbed industrial land area in the first five months of 2024 was 12% higher than the same period the previous year.

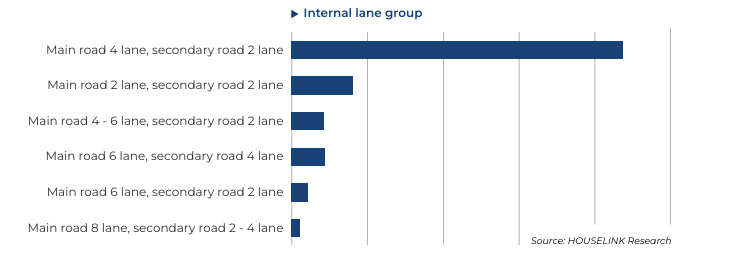

According to our survey on the internal transportation infrastructure of Industrial parks nationwide, so far, the basic internal transportation infrastructure of Industrial parks largely meets the standard design criteria for internal transportation infrastructure within the zones. As such, most Industrial parks are constructing main roads with 4 lanes and secondary roads with 2 lanes. Following this, main roads with 2 lanes and secondary roads with 2 lanes are also common. Other road categories have a relatively lower proportion.

Vietnam is placing significant emphasis on investing in infrastructure development, particularly in transportation infrastructure. A major advantage of domestic Industrial parks currently lies in their connectivity transportation infrastructure. Up to 67% of Industrial parks are developed adjacent to national highways. These are vital trade routes, convenient for the transportation of goods, contributing to facilitating logistics operations for businesses within the Industrial parks. Especially with the ongoing improvement of the highway system such as the North-South expressways connecting the country lengthwise and coastal roads, they are contributing to the promotion of industrial development specifically and the economy in general in the provinces and cities through which these roads pass.

Most Industrial parks currently primarily rely on the national grid for electricity supply. Additionally, some zones combine the national grid with other sources such as thermal power, solar power, and wind power. According to our data, nearly 50% of Industrial parks have installed rooftop solar power systems in their factories. This indicates that investors are increasingly focusing on using renewable energy sources to gradually replace reliance on the national grid, aiming towards green production standards and green Industrial parks.

According to the survey conducted by HOUSELINK, approximately 60% of Industrial parks are located very close to residential areas. Particularly notable are provinces and cities such as Bac Ninh, Binh Duong, Dong Nai, Hanoi, and Ho Chi Minh City, where nearly 100% of Industrial parks are situated very close to residential areas. This is one of the favorable conditions for attracting investors as well as laborers.

Infrastructure facilities are being significantly improved as services such as supermarkets, hospitals, customs offices, and fire departments are being arranged quite close to Industrial parks. Moreover, some zones are even constructing these infrastructure facilities within the zone itself. This creates favorable conditions for attracting and ensuring the daily living standards of laborers.

Trends in rental prices for various types of industrial real estate

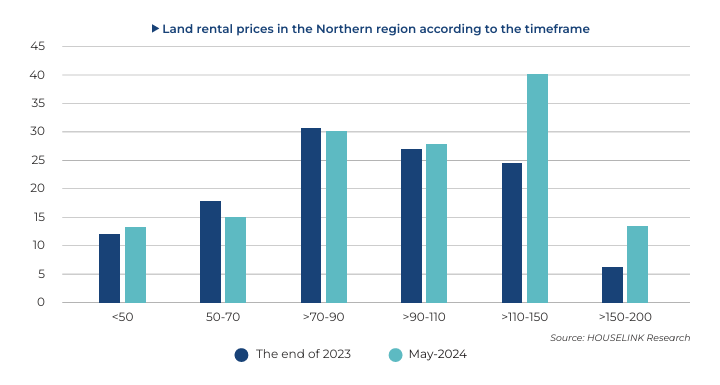

Based on a successful survey of 267 Industrial parks, compared to the end of 2023, we have observed clear differences in rental price ranges for land in the second quarter of 2024, especially in higher rental price ranges. While at the end of 2023, Industrial parks mainly fell within rental price ranges of <=50 USD/m2/lease term, 50-70 USD/m2/lease term, and 70-90 USD/m2/lease term (comprising 62% of the total number of Industrial parks), by the second quarter of 2024, the rental price range of <=50 USD/m2/lease term has significantly decreased (by 7% compared to the end of 2023). Instead, the rental price range of >150-200 USD/m2/lease term has shown an increasing trend (up by 4% compared to the end of 2023).

The rental prices for ready built – factory spaces in the second quarter of 2024 have also changed compared to the end of 2023, albeit not significantly. This shift in rental prices for RBF spaces only occurred in the ranges of 2-3 USD/m2/month and >5 USD/m2/month. Contrary to the trend of increasing rental prices for land, the rental prices for RBF spaces are trending downwards, with the range of >5 USD/m2/month decreasing by 2% compared to the end of 2023, while the range of 2-3 USD/m2/month increasing by 2%. Additionally, the majority of Industrial parks are still in the range of 3-5 USD/m2/month (comprising over 60% of the total number of Industrial parks).

In the second quarter of 2024, GDP growth is forecasted to reach 5.3%, after being revised down from 6.3% by Standard Chartered Bank due to Vietnam’s lower-than-expected GDP growth in the first quarter, as well as uncertainties in international trade activities – which are considered drivers of growth, and Vietnam’s investment facing headwinds both in the short and long term due to the volatile global situation.

Despite the positive signals of GDP growth in the first quarter, the Vietnamese economy still faces inflationary pressures. The Consumer Price Index (CPI) continues to rise, with core inflation increasing until April and slightly decreasing in May. In general, in the first five months of 2024, the CPI increased by an average of 4.03% and core inflation increased by an average of 2.78% compared to the same period last year. Core inflation increased less than the CPI because mainly the prices of items causing CPI to rise were excluded from the core inflation calculation.

The overall Industrial Production Index (IIP) of Vietnam’s industry in the first five months of 2024 increased by 6.8% compared to the same period last year – marking a significant recovery from the 2.0% decline in 2023. The increase in IIP in the first five months of 2024 was contributed by an improvement in the number of orders from businesses compared to 2023, starting from the beginning of the year.

After a period of decline in import-export values due to a decrease in the number of orders and significantly reduced consumption demand from major countries, Vietnam’s exports and imports both recorded good growth in the first five months of 2024. The import-export turnover reached its highest value since 2020. Specifically, exports reached $156.8 billion (up 15.2% compared to the same period last year), and imports reached $149.8 billion (up 18.2% compared to the same period last year). The trade balance for goods achieved a surplus of $8 billion. During the first five months of this year, Vietnam primarily imported from China with a turnover of $54.9 billion. Meanwhile, the United States was Vietnam’s largest export market, with a turnover of $44.0 billion.

The potential to attract investment projects into industrial parks

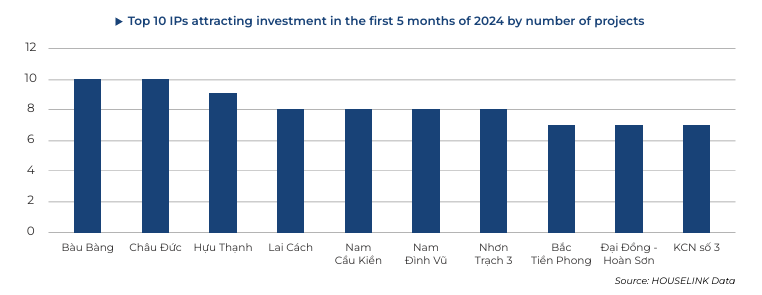

The investment attraction situation of the first half of 2024 shows quite positive signals. In terms of project quantity, the first 5 months of 2024 indicate the strongest recovery since the impact of the Covid pandemic (increasing 2-3 times compared to the same period in previous years). Particularly, the number of investment-attracted projects in Vietnam during the first 5 months of 2024 increased by 11% compared to the same period in 2019 (before the pandemic), showing a continuous upward trend in 2022, 2023, and 2024, demonstrating Vietnam’s recovery and breakthrough in investment attraction. In terms of total investment amount, the first 5 months of 2024 recorded the highest investment capital in the past 6 years. It is evident that Vietnam is increasingly attracting numerous projects in both quantity and quality, appealing to domestic and foreign investors participating in the market.

China is the country with the highest number of investment projects in the first half of 2024. Following China are Hong Kong, Taiwan, South Korea, and Singapore. Hong Kong ranks second in terms of the number of projects but has a relatively low total investment amount. In addition, South Korea’s investment projects rank fourth in terms of the number of projects but have a significant investment scale, ranking second only to China.

According to updated data from HOUSELINK, in terms of proportion, the trend for leasing factories showed a decrease in 2023 but started to trend upwards in the early months of 2024. The growth trend of factory leasing is becoming more pronounced, with the number of projects leasing factories almost equaling or exceeding those leasing land. The increasing trend in factory leasing is driven by the fact that most investors relocating their production to Vietnam already have orders in hand. Therefore, they need to shorten the time to start production in Vietnam, and factories are their top priority choice, especially given the current situation where the supply of industrial land is slowing down due to legal factors and implementation costs.

In contrast to the trend for leasing factories, the proportion of projects leasing land showed growth in 2023 but decreased in the early months of 2024. It can be observed that in the fourth quarter of 2023, there were signs of an increase in the proportion of projects leasing land compared to those leasing factories. However, by the beginning of 2024, the number of projects leasing land began to decrease, leading to a decrease in the proportion of this type of project compared to those leasing factories in the early months of this year. The decrease in land leasing can be attributed to the continuous rise in land rental prices in key provinces and cities, causing concerns among investors. Additionally, the current land supply is also limited.

In the past 3 years, the most prominent investment-attracting provinces and cities nationwide have been concentrated in the northern and southern regions. Notable examples include Bac Ninh, Binh Duong, Long An, Dong Nai, and Hai Phong, which have been attracting investors for some time, creating industrial complexes with nearly complete supply chains in both manufacturing and supporting industries. The Red River Delta and the Southeast are still the two regions with many provinces and cities attracting investment in the industrial sector.

Here you can access reports on Vietnam’s construction market and industry investments.

Please sign up to receive periodic reports by filling up the form below.

Source: HOUSELINK