Investment report -Vietnam’s Textile and Garment supply chain Q1/2023

After 2021, global GDP recorded a strong recovery post-Covid thanks to the acceleration of vaccination campaigns and the restoration of economic trade, but in 2022 the world economic was negatively affected by the military conflict between Russia and Ukraine, leading to high fuel prices and inflation. In the first months of 2023, the world economic situation has not shown positive signs when inflation is still high, demand decreases and global economic growth is expected to be lower than in 2022 (2.7% according to World Bank).

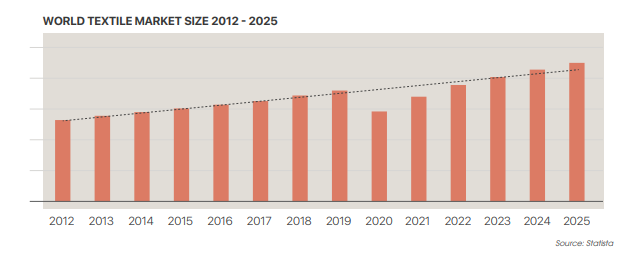

Global textile and garment industry still maintains growth trend. In 2020, when Covid-19 pandemic caused global economic crisis, most industries were seriously affected and the industry was no exception. Nonetheless the situation is getting better as most countries reopen in 2022.

Vietnam’s GDP growth by 3.32% in Q1 2023 compared to 2022 according to the General Statistics Office (GSO). This is the lowest GDP growth in the past 5 years, lower than the target assigned by the National Assembly. However, with the on-going conflict in Ukraine, along with Vietnam still being in the early stages of post-Covid recovery, this is an acceptable growth rate and reflects the reality of the economy in 2023 when challenges outweigh opportunities.

The export value of the industry is still on a growing trend. Due to the impact of the Covid pandemic, the export value decreased in 2020, but from 2021 onwards textile and garment exports are rebounding, especially in 2021 with the introduction of the Covid-19 vaccine, and thus the economy was stabilized, the growth of textile and garment products and fibers and textile fibers of all kinds increased. However, by Q1 2023, the export growth value of textile products, garments and fiber products, textile fibers of all kinds decreased sharply compared to the same period in 2022 (down 17.4% and 33.9%, respectively). This was mainly due to the decrease in orders by the drop in demand from the main exporting markets such as the EU and the United States.

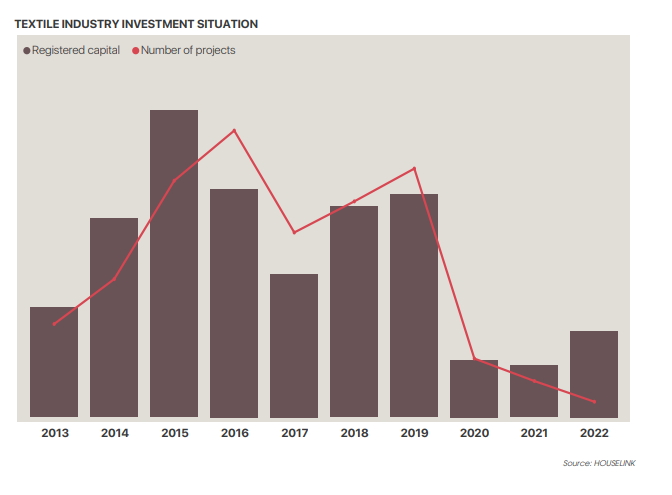

Investment in the textile and garment industry has passed its recent prime. Before the pandemic, investment trend has begun to decline slightly. The impact of the Covid-19 pandemic has led to a decrease in both capital and the number of projects investment in Vietnam’s textile and garment industry.

Looking at the chart, it can be seen that the number of investment projects in Vietnam tends to grow quite steadily in the period before 2019. However, when the Covid-19 epidemic began to affect and cause obvious consequences in Vietnam (starting from the beginning of 2020) along with the influence from the world economy and politics, Vietnam recorded a continuous decrease in the number of projects in three years 2020, 2021, 2022. The Q1 2023 situation has yet to record a recovery in industry investment attraction, mainly due to the decrease in global demand.

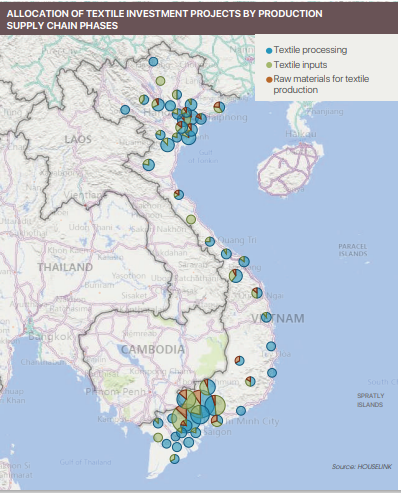

From 2013 up until now, the majority of investments are garment and apparel manufacturing (by number of projects). Projects with large registered capitals are processed materials such as woven textiles, processed yarns, sewing threads, followed by garment and apparel manufacturing. As they accounted for a large proportion in the investment supply chain, manufacturing projects are distributed evenly in all three regions. Projects on processed and raw materials are mainly concentrated in the South. Dyeing projects are being restricted due to problems related to environmental pollution.

Allocation of textile investment projects according to supply chain

Source:HOUSELINK