Investment Report – Viet Nam Electronics Industry Supply Chain Q1/2023

After 2021, the world’s GDP recorded a strong recovery after the Covid epidemic thanks to the promotion of vaccination campagins and the restoration of economic trade. However, in the following year, the global economy suffered a negative impact from the military conflict between Russia and Ukraine, leading to high prices of energy, fuel and inflation.

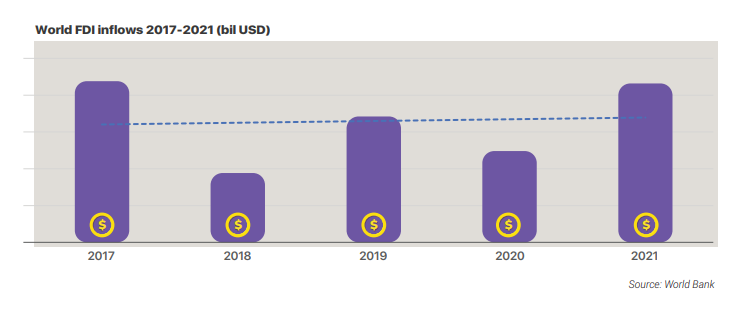

Global FDI was trending slightly upwards from 2017 to 2021. 2020 was heavily impacted by the pandemic in most countries in the world, causing severe economic repercussions. However, in 2022, the application of Covid vaccines has helped us to stabilize to some extent and revive the economy.

Estimated Vietnam’s GDP growth for 2022 is expected to increase by 8.02% compared to the same period last year, according to the General Statistics Office (GSO). This is the highest growth rate in a decade. In the context of the world still facing complex economic problems with inflation shocks in many countries at the beginning of 2022 and Vietnam being in the early stages of post-pandemic growth, this growth figure is extremely impressive, demonstrating a very clear economic recovery.

Factors affecting investment in the electricals – electronics industry in Vietnam

Labor factor: Electronics is one of the industries that employs a lot of workers (second only to textile and footwear industries for FDI enterprises), so the labor force is always a pressing issue.

According to Decree No. 31/2021/ND-CP, manufacturing of electronic accessories, components, and electronic modules are among the industries encouraged and enjoying incentives when investing in Vietnam by the Government. In addition, investment projects with a capital of more than VND 6,000 billion (equivalent to about 250 million USD) – large assembly projects investing in Vietnam’s electronics industry according to HOUSELINK’s statistics often have similar capital levels, and also receive investment incentives when investing in Vietnam.

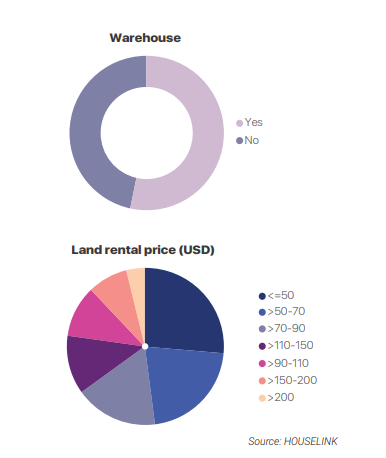

Vietnam industrial real estate infrastructure

We recognize that each region has different location advantages. While the North has many industrial zones near highways, the Central region has the advantage of a long coastline, and industrial zones are also located along coastal roads, making them very close to seaports and convenient for import-export and trade of goods.

Status of investment projects in the electricity and electronics industry

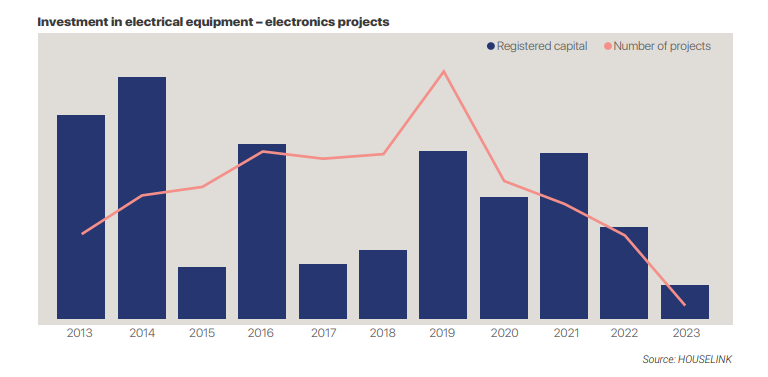

The number of investment projects in the electrical equipment – electronics industry

has shown a continuous increase but decreased during the Covid-19 pandemic

period. So far, there have been no signs of full recovery, but in the first two months of

2023, the scale of capital has shown signs of returning growth.

Looking at the graph describing the situation of attracting investment in the electronics industry since

2013, the number of investment projects into Vietnam has tendency to grow quite steadily in the period

from 2013 to 2019. The average growth rate reached 21.25% in this period, peaking in 2019. However,

when the Covid-19 pandemic began to affect Vietnam (from early 2020) along with the impact from

the global economy-politics, Vietnam recorded a continuous decrease in the number of projects in

three years 2020, 2021, 2022. As of the beginning of 2023, the number of projects has not shown

signs of growth returning.

Northern region excels in attracting investment in the industry

In terms of the number of projects or the scale of registered investment capital, the Northern region still dominates with over 78% of the total number of projects concentrated in the North. Therefore, most large-scale projects choose Northern provinces as investment destinations, with over 81% of investment capital poured into the North affirming the clear direction of dividing investment-attractive industries among the three regions. With such a majority proportion, the Northern region is shaping the trend of investment attraction in the electronics industry for the whole country.

HOUSELINK