5 Reasons Why Rooftop Solar Needs to Make The Technology Jump

Pick Smart

India’s ambitious solar targets of 100 GW by 2022, and 450 GW by 2030, are largely built around massive ramp ups in large scale deployments, or ‘utility scale’ solar. These comprise designated solar parks, even ultra large parks, and other hundred MW plus installations that will feed into the grid directly. But the country has a clear problem.

The whole focus on going large was driven by expected economies of scale, and consequently, lower costs per unit of power. Quite simply, that might have built us one of the world’s largest and possibly most outdated solar capacity network so far. Based on polycrystalline solar for instance, even as the rest of the word moves on to Mono Perc and beyond.

Rooftop Solar, on the other hand, is a whole new world, with completely different requirements. Be it comparisons with expensive grid power, or space constraints, its role as a primary or supplementary energy source, or the owners own investment into the plant, thinking short term here is a recipe for disappointment here. We list down 5 reasons why you should be looking hard at module technology first when it comes to your rooftop requirements.

1. Rooftop Solar is not Stifled With Price ‘Ceilings’. While a large part of the residential rooftop segment is wedded to a controlled pricing regime due to its linkage with central subsidies and state agencies that approve vendors, a significant part, the commercial and industrial segment (C&I), is free of such controls.

Here, decisions are being taken today on cold numbers, and solar is still winning regularly, thanks in no part to very high grid tariffs for this consumer. With better prices and models like RESCO (Renewable Energy Service Company) or opex, it has been in the interest of developers to make quality a key factor when it comes to modules, and that has shown in the results.

2. It can actually support domestic upgrades. The FAME 2 guidelines for electric vehicles is a case in point. By shifting subsidies towards lithium ion batteries from regular lead acid batteries in electric vehicles, it has forced domestic industry to start the shift faster.

Rooftop solar subsidies too need to nudge buyers towards a technology upgrade, from polycrystalline modules to newer versions. If that means a pause in lowering of rates, it is a worthwhile investment for long term energy production during the service life of PV plants.

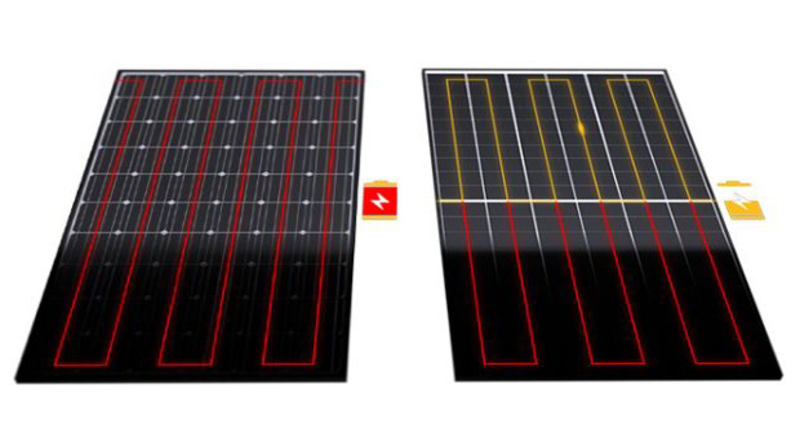

Most importantly, it will give domestic manufacturers a bigger market to target, and consequently invest in a product upgrade themselves. This will also mean that we are in line with the rest of the world where the Residential and commercial segment has already adopted newer technologies like bifacial modules, for instance.

3. The 25 year life acquires real meaning here. In developed markets, a solar rooftop is supposed to add to the real estate value of the house. In India, owners need to see it as an appreciating asset, that can actually generate higher returns YoY considering the upward, trajectory of grid power costs.

Performance degradation in residential rooftop has regularly outstripped utility scale plants, for reasons related to subpar quality of equipment and installation. Studies done by PV Berlin, or the IIT Mumbai backed NCPRE both point to a massive gap in the quality of installations across the country. That kind of short term thinking needs to be junked.

4. The current component manufacturers have cleverly pivoted the discussion around Wp, where higher is better. Whereas, for a rooftop owner, the discussion needs to go from buzzwords like Wattpeak (WP)of the module- what matters is how the modules are performing in real-conditions backed by real data from ground and what is the PR i.e Performance ratio and energy density. In this case, it is the owners own money at risk, itself a strong case to consider quality with a critical eye.

5. Future Proof against forced upgrades. For a 25 year investment, it is critical to go with technology and service standards that can deliver. Firms offering a high level of service support backed by a real record on the ground are signalling their commitment to the market. Go with those.

International manufacturers like the REC Group, a Norway-based firm have built their whole model on this assumption in India, where they focus exclusively on the commercial and industrial segment. The firm, which builds its full line of products completely in Singapore, has shifted to next-generation technologies like HJT (heterojunction technology) in their panels, to stand out from the crowd with discerning customers.

According to Rohit Kumar, Head of Indian Subcontinent (REC Solar), “HJT or heterojunction technology has been around for some time, but what we have done is that we have adopted it and commercialised it. It’s incredibly innovative as it builds upon the proven track record of thin-film and N-type Mono cells- combining both of these to give you an end product which not only gives you higher energy output but the energy yield is consistently high throughout the 25 years lifetime, and therefore a very good ROI for a homeowner or business who is looking for maximising the output and potential of their rooftops. You can not only power more panels in your existing space but also have a much lower degradation with modules performing at 92% at the end of 25 years. With REC we back this with an unparalleled product warranty of 25 years along with Labour warranty and performance warranty- giving you a complete peace of mind”

At just over 5.5 GW today, rooftop solar in India has a long runway to 40 GW, its original target for 2022. To truly take off, its customers need to make the right choices now.

Source: Saurenergy