Investment report – Supply chain of electrical equipment manufacturing industry Viet Nam

The Year of 2022 is the year that the world economy suffers many negative impacts. The consequences caused by the Covid-19 epidemic, the energy and food crisis caused by the Russian – Ukraine war, which pushed up prices and inflation rate, China is still carrying out the blockade measures to prevent the epidemic, which has made the economy during the 9 months of 2022 very bleak. Facing these economic risks, most of the experts forecasts the economy cannot be recovered in the next quarter, global economic growth still has many challenges in terms of politics, epidemics, and inflation, … In that context, the latest forecast of global GDP growth in 2022 will only fluctuate between 2,4%-3,2%.

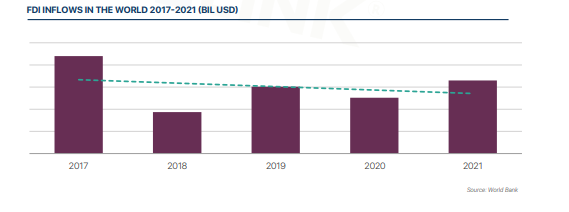

World FDI is on a downward trend from 2017 to 2021. In 2021, global FDI flows increased by 30% compared to 2020. However, in 2022, global FDI is quite gloomy compared to 2021 due to the impact of uncertainly on investor behavior, risks from supply chain disruptions and the increasing of raw material costs and other risks from political and economic conflicts in the world. Global FDI is forecasted to be flat or down compared to 2021.

China is the largest exporter of electrical equipment in 2021 with 898,9 million USD, followed by Hong Kong with 395,5 million USD. In 6 years (2016 – 2021), China has always maintained the leading position in the export market of the electrical equipment industry. Besides, in terms of import market, in the five years of 2016 – 2020, the US is the leading country in the import market of electrical equipment, but by 2021, China has surpassed and become the world’s largest importer of electrical equipment.

Viet Nam’s GDP growth in the third quarter of 2022 is estimated to increase sharply by 13.67% over the same period last year according to the General Statistics Office (GSO). This is the highest Q3 growth rate over the past decade. In the context of complicated world situation with inflation shocks in many countries at the beginning of 2022 and Vietnam is just in the early stages of post-pandemic growth, the growth figure is very impressive, showing that the economy is thriving very clearly.

In the electrical equipment industry, electric wires and cables are among the most exported products. The export value of electric wire and cable products is still showing a clear growth trend. In 9 months of 2022, the export value of this product has a slight increase compared to the same period in 2021. China and the US are two major export markets of Vietnam in this industry.

Status of investment projects in the electrical equipment industry

Investment in the electrical equipment industry showed a continuous increase before 2020 but decreased during the period of the Covid-19 epidemic, so far there is no sign of a full recovery.

In terms of total investment capital, Vietnam’s electronics industry market records 5.5 billion USD in total registered capital and 339 total projects from 2013 to present and heavily depended on the big players in the industry, especially from FDI capital sources. The good news is in 2019 and 2021 recorded many large-scale capital investment projects. The capital flow over the years has fluctuated strongly, not in a clear increasing direction like the number of projects, but in general, there is an increasing trend. Crucially, DDI capital projects in recent years tend to be more flourish, both in 100% DDI capital projects and DDI-FDI capital joint ventures.

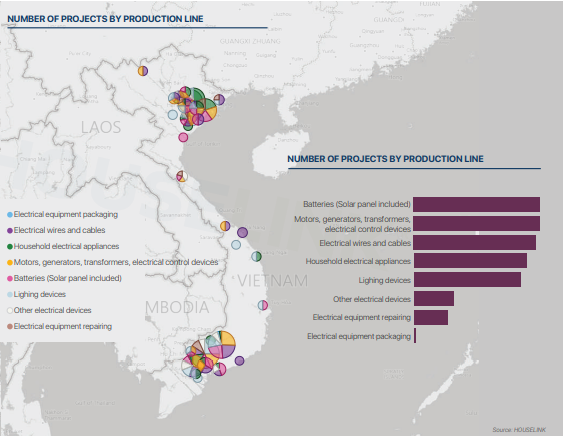

The North attracts the largest scale of registered investment capital and the most projects among three regions, especially in the provinces and cities of the Red River Delta economic region.

In term of the scale of registered investment capital, the registered capital in the electrical equipment industry, especially in large scale projects, is mainly located in the Northern provinces over most of the years. Except in 2019, the amount of capital poured mostly into the Southern provinces. Prominent provinces are Bac Giang, Quang Ninh and Ho Chi Minh city. The Central region has a significant project as Vines factory project in Ha Tinh. In which, processing and assembly projects account for the largest amount of capital.

In terms of the number of investment projects,

The North is the region with the highest concentration of electrical equipment projects followed by the South and the projects has scattered distribution in the Central. Since the Covid-19 epidemic appeared, the number of projects has decreased sharply and there is no prospect of recovery in 2022.

Some of the provinces and cities that attract many projects in the electrical equipment industry include Binh Duong, Dong Nai, Bac Ninh, Bac Giang and Long An. We can observe that among the top 5 provinces that attract the most projects, 3 are from the South. This shows that in terms of attracting the number of investment projects, there is not a clear distinction between the North and the South. But in the South, there are a few main provinces, while in the North, investment locations are selected and distributed more widely.

Supply chain of investment in the electrical equipment industry in Vietnam

The investment supply chain has not yet completed, most of the investment projects are processing and assembly type.

From 2013 until now, the supply chain of investment in the electrical equipment industry in Vietnam currently mainly focuses on the processing and assembly type, the components, parts productions ranks the 2nd, the supporting industry segment has not received much attention. In which, the outstanding projects are processing and assembly, account for the large share in our electrical equipment industry both in terms of quantity and registered capital (206 projects and 4,08 billion USD). This is the current situation not only of the electrical equipment industry, but in most industries, investment projects in Vietnam are mainly in the field of processing and assembly. Raw materials are mainly imported from aboard.

Parts and components production projects are concentrated in the Northern market, the projects here are relatively large. Looking at the map below, currently the Northern market is attracting the most capital sources, where there are projects located in all stages of the industry supply chain, especially the processing- assembly and production of components-parts. In the South, investment capital still mainly comes from processing and assembly projects. We consider that the supply chains in all three regions are incomplete, especially in the support and repair industries.

In the Vietnam market, according to the number of projects, there is an equal attraction among production types. The most prominent is the production of motors, generators, power distribution equipment. The batteries and accumulators’ production are the most attractive type. The second is the production of wires and equipment, followed by the production of electrical appliances and electrical lighting equipment. Most production types have a strong downward trend in 2022. But in terms of growth, battery, and accumulators ‘production projects (especially solar cell production) have grown rapidly, especially in 2021 (increased by 560% in term of total registered capital compared to 2020). Although in 2022, the battery and accumulators’ production projects decrease in the number of projects and registered capital compared to 2021, they are still higher than in other years before. This production type is also considered as one of the most attractive manufacturing industries now.

Electrical equipment projects about to take shape in the future

Based on project data with an investment greater than or equal 2 million USD (equivalent to 48 billion VND) from foreign direct investment (FDI) and domestic direct investment (DDI) sources on the HOUSELINK platform in the field of electrical equipment manufacturing; We synthesize, analyze data, and make reports on projects that are under construction and are in the process of preparation (project preparation, design, contractor selection). All projects have been verified by HOUSELINK.

According to our data, most of the upcoming projects are concentrated in the North (account for 62% of the total project numbers), 23% of the projects are about to be implemented in the South and about 15% of the projects are about to be implemented in the Central region. In the future the North market will continue to be an attractive market for electronics projects. Especially, most of them are projects in the preparation stage, have not yet called for bidding and have not selected a main contractor.

In terms of construction type, in addition to expansion projects of existing investors, Vietnam also attracts a lot of attention from new investors in the electrical equipment industry. Although the number is not too much, the difference between new construction and expansion projects in terms of quantity is not too large, which has partly helped diversify the electrical equipment market in Vietnam in the future.

This report is released in Vietnamese version, English version, Chinese Version.