Summary Report – Investment Supply Chain Manufacture Of Fabricated Metal Products In Vietnam

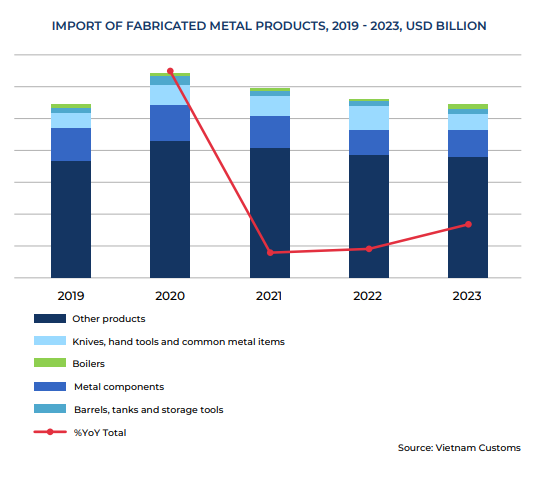

Metal components and other metal products are the two most imported product categories into Vietnam, accounting for up to 90% of import value, with other metal products making up nearly 70% of this share on average.

Imports of fabricated metal products have shown a slight decline during the period of 2021 – 2023. Specifically, import volumes decreased by 7% in 2021 and continued to decline by an additional 6% in 2022 compared to the previous year. Notably, imports of metal components decreased even more significantly, by 9% and 21% in those two years, respectively. The main reason for this decline was the impact of the COVID-19 pandemic, which led to a sharp reduction in demand for these products in the manufacturing and construction industries. In 2023, imports experienced a slight recovery, with a reduction of only 3%. While they have not yet returned to growth, the rate of decline has lessened.

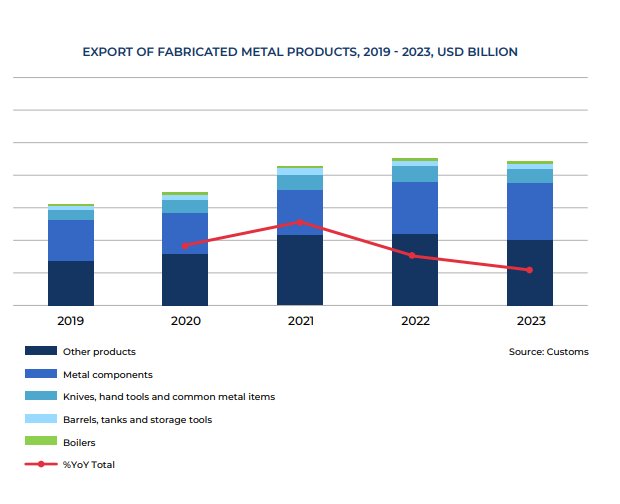

Exports of fabricated metal products have shown an upward trend from 2019 to 2023, with significant increases in 2020 and 2021 of 11% and 24%, respectively, compared to the same period the previous year. Metal components and other fabricated metal products account for the largest share of exports.

Supply Chain Of The Fabricated Metal Products Industry

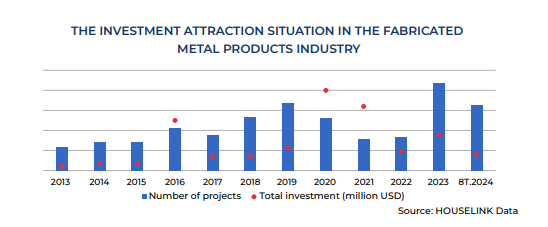

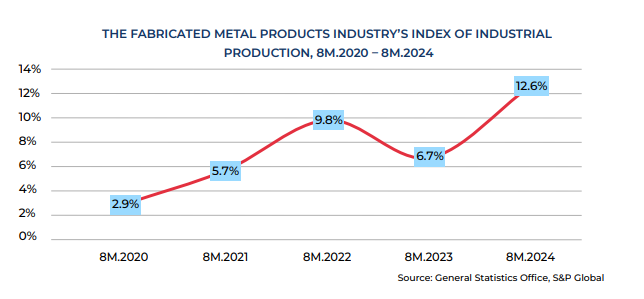

Overall, the investment situation in projects of fabricated metal products industry is showing a positive growth trend in the number of projects. From 2013 to 2019, the CAGR reached 20%. A decline began

during the three-year period affected by the Covid pandemic (2020 –2022). However, in 2023, the number of investment projects showed a strong recovery, increasing by nearly 160% compared to 2022. Furthermore, looking specifically at the first 8 months of each year, the number of attracted investment projects in the first 8 months of 2024 recorded the highest figure since 2013 (Increase about 25%

compared to the same period in 2023). It is forecasted that in the remaining months of 2024, the number of investment projects in the metal industry could exceed that of 2023.

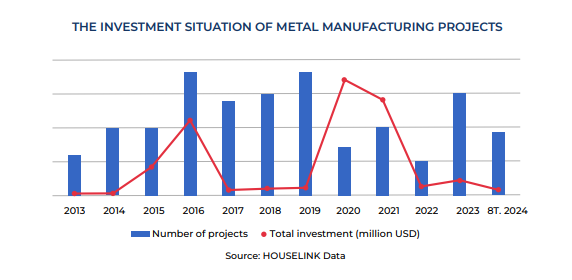

Investment projects in the metal manufacturing industry were showing good growth trends before the Covid pandemic, but post-pandemic, a slight decline began to emerge. In terms of project quantity, the period from 2013 to 2019 saw stable annual growth. However, at the time of recovery after the pandemic, the number of metal manufacturing investment projects started to show signs of recovery. In 2023, the number of projects increased by 200% compared to 2022.

Factors Driving The Fabricated Metal Products Industry

In Q2 2024, Vietnam’s total GDP growth reached 6.9%—a significant increase compared to 4.1% in Q2 2023, and second only to Q2 2022, in the context of the global economy still facing headwinds due to political instability, armed conflicts, and supply chain disruptions. This growth exceeded the expected 6.6% outlined in the Government’s Resolution 01/NQ-CP and led the economic growth in Southeast Asia during the second quarter. The GDP of the Industry & Construction sector in Q2 2024 recorded an impressive growth of 8.3%.

Compared to the same period last year, the consumer price index had been steadily increasing from the beginning of the year until May. However, inflationary pressure has gradually eased since June, with a sharp decline in August, reaching 3.45% year-on-year. The overall decrease in prices will help lower the costs of factors in the production of fabricated metal products, thereby reducing general production costs. At the same time, it will boost consumer and business purchasing power, helping manufacturers

and traders gradually improve their business efficiency.

FDI inflows into Vietnam reached their highest level in the first eight months of the 2020-2024 period. Total registered capital exceeded $20.52 billion, a 7% increase year-on-year, while implemented capital reached $14.15 billion, up 8% from the same period. New capital inflows grew in both registered capital ($12 billion, up 27%) and the number of projects (2,247 projects, up 8.5%), with average investment size increasing to over $5.3 million per project compared to $4.6 million in 2023. Adjusted capital also rose, with total registered capital reaching $5.71 billion (up 14.8%) and the number of projects growing to 926 (up 11.6%). These figures highlight Vietnam’s attractiveness to foreign investors, driven by advantages such as numerous free trade agreements, a large workforce, competitive labor costs, and stable

economic and political conditions.

An open economy with 16 signed Free Trade Agreements, coupled with favorable investment policies, provides a strong founda[1]tion for investment, market expansion, and business growth in Vietnam, as well as for export activities.

A large population, along with highly competitive labor and operational costs compared to other countries in the region, makes Vietnam attractive for both trade and manufacturing purposes.

Vietnam is intensifying its involvement in the upstream segments of the supply chain, paving the way for the participation of downstream FDI companies.

Here you can access reports on Vietnam’s construction market and industry investments.

Please sign up to receive periodic reports by filling up the form below.

Source: HOUSELINK