Summary Report- Implementation Of Industrial Projects In Vietnam – Quarter III/2024

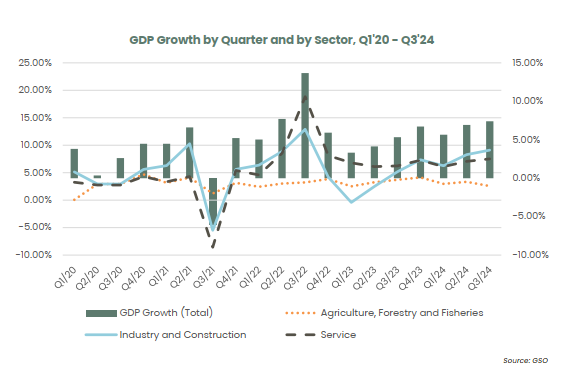

Vietnam’s GDP in the third quarter of 2024 reached 7.4% compared to the same period last year, driving GDP growth for the first nine months of this year to 6.8%. Among all sectors, industry and construction exhibited the strongest growth, with a 9.11% increase in Q3 2024. Cumulatively, for the first nine months, the GDP of the industry and construction sector rose by 8.19% compared to the same period in 2023.

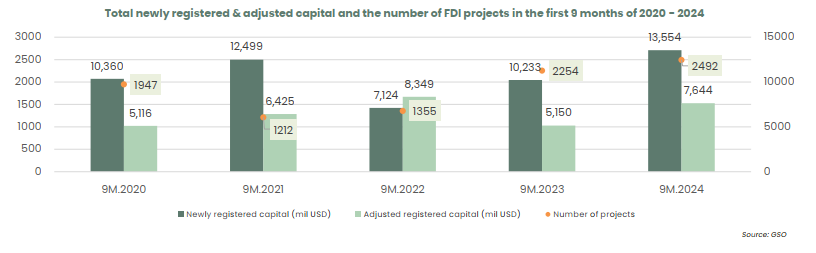

FDI attraction has been a highlight in Vietnam’s economic landscape during the first nine months of 2024. Specifically, 2,492 FDI projects were licensed during this period, marking an 11% increase compared to the same period last year. The total registered capital for new and adjusted investments reached USD 13,553.8 million and USD 7,644 million, respectively, representing year-over-year increases of 32% and 48%, the highest in the past five years.

Overall, Vietnam’s PMI in September 2024 fell to 47.3 points. This marks the second time in 2024 that the PMI has dropped below the 50-point threshold. The aftermath of Typhoon Yagi in early September significantly disrupted production schedules, leading to quality control issues, order delays, and a reduction in new orders for manufacturing businesses. However, with a substantial increase in new orders during mid-year, it is forecasted that Vietnam’s PMI will recover quickly in the final months of 2024, returning to a level above the 50-point threshold, indicating a resumption of growth.

In the first nine months of 2024, the total import-export turnover reached USD 578 billion, the highest in the past five years. Of this, exports amounted to USD 299 billion, a 15% increase compared to the same period last year, while imports totaled USD 279 billion, up 17% year-over-year. Regarding export markets, the foreign-invested sector accounted for the majority, making up approximately 72% of total export value. This sector also dominated in terms of imports, representing 64% of total import value.

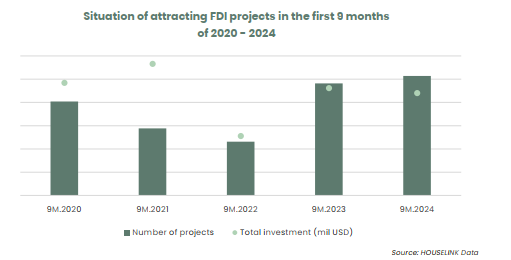

Vietnam’s overall FDI attraction has recorded good growth during the first nine months of 2024. However, a deeper analysis of newly registered FDI projects involving leased factories or industrial land presents a different perspective on the current state of investment attraction in Vietnam. In terms of project quantity, the number of registered projects in this period reached the highest level in the past five years, increasing by 7% compared to the same period in 2023

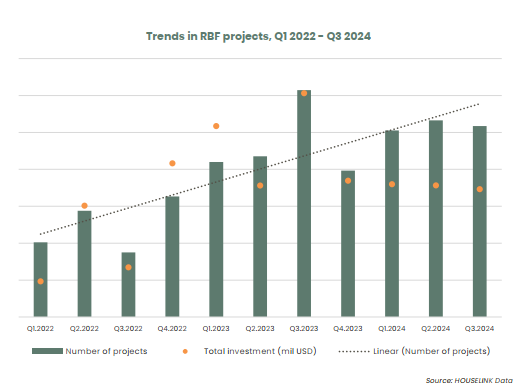

The trend of leasing factories has been on the rise in recent years, with an average annual increase of about 16% in the number of projects. In 2024, the number of factory leasing projects has remained relatively steady across the quarters. Although the number of leasing projects in Q3 2024 decreased by approximately 16% compared to Q3 2023, the increases in Q1 and Q2 of this year offset this decline, resulting in a slight overall increase of 6% in the total number of factory leasing projects during the first nine months of 2024 compared to the same period in 2023.

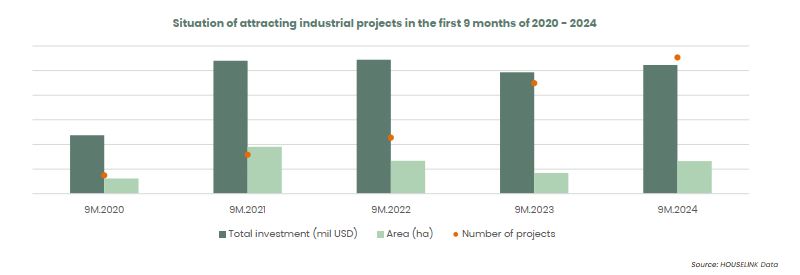

According to data from HOUSELINK, the number of land lease projects with an investment capital of over $2 million has shown a positive growth trend in the first nine months of each year from 2020 to the present. In the first nine months of 2024, the number of projects recorded in the HOUSELINK system reached its highest level in the past five years, increasing by 23% compared to the same period last year. While the number of projects has increased significantly, the overall investment capital growth rate has not been as high. In the first nine months of 2024, total investment rose slightly by 6% compared to the same period in 2023, and it was lower than the figures recorded in the first nine months of 2021 and 2022.

Here you can access reports on Vietnam’s construction market and industry investments.

Please sign up to receive periodic reports by filling up the form below.

Source: HOUSELINK