Implementation report of industrial projects in Vietnam – Quarter 3/2022

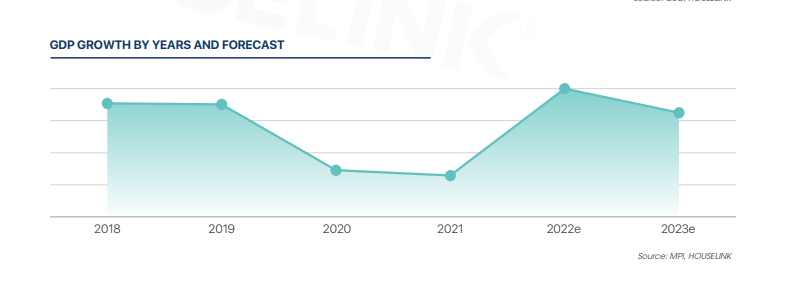

In the third quarter of 2022, the country’s GDP growth reached 13.67%, the highest in the third quarter of the last 5 years (2018-2022). The industry and construction sector and services, agriculture, forestry, and fishery sector also maintained an increase compared to the same period of last years.

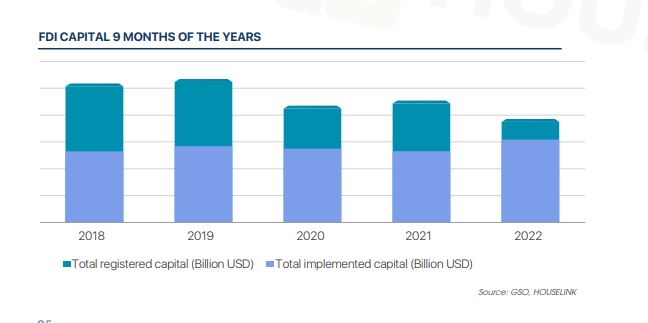

The total value of foreign direct investment capital into Vietnam in 9 months of 2022 is about 18.75 billion USD. The total registered capital of all newly registered, adjusted and contributed capital to buy shares projects decreased by more than 15% compared to the same period of 2021 and became the lowest number in the same period of the previous years. The sharp decline in world FDI, and geopolitical and economic conflicts led to a decrease in foreign investment capital.

The IIP was estimated to increase in the third quarter of 2022 (by 11.9% over the same period last year), the industrial operation activities in general are still on the recovery and growth. The IIP of large industry groups had an increasing trend, including: The mining industry increased by 6,2%, the processing-manufacturing sector increased the most (12,5%), the electricity production and distribution industry increased by 11,2%, the water supply, management and treatment of waste and wastewater also achieved good growth with 8.9%.

Implementation Situation Of Vietnam Industrial Projects Q3 2022

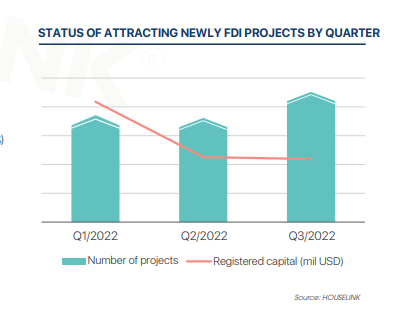

In the third quarter of 2022, the whole country attracted about 90 newly FDI projects in the field of processing-manufacturing and warehouse construction sector. The number of projects increased 5% compared to the same period last year. However, in term of the amount of registered investment capital, in the third quarter of this year, the total amount of registered capital was only 70% of the attracted capital in the same period of 2021. The average capital of project also decreased by 36% over the same period last year.

Based on the newly investment FDI attracted into Vietnam from the beginning of 2022 until now, we see a decrease in registered investment capital from Q2 and maintained a slight decrease in Q3 (down by 3%) but the number of projects increased (Number of projects in Q3 increase by 25% compared to Q1 and Q2). We believe that in the fourth quarter of this year, both the number of projects and the scale of investment capital may increase slightly compared to the third quarter because this is the end of the year, investors, especially Chinese investors and Vietnam’s authorities tend to complete procedures at the end of the year.

Although ready-built factory (RBF) leasing is an increasing trend in 2021, in the third quarter of 2022 we see a slight decrease in RBF for lease projects compared to the same period in 2021. The land lease projects still account for the majority of newly invested FDI projects in Vietnam in the third quarter of 2022 (accounting for 73% of the number of projects) generally.

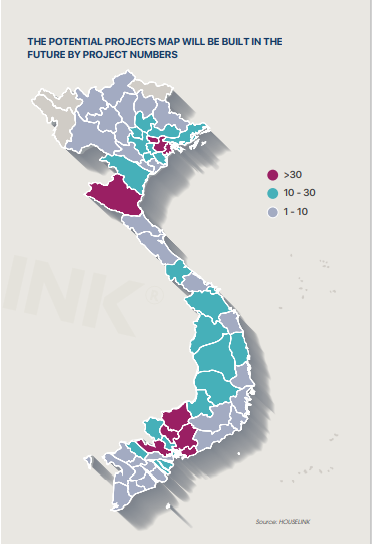

In this Report, HOUSELINK focuses on analyzing projects that are in the process of being prepared for construction (Project preparation, design, bidding, main contractor selection) and projects under construction based on criteria: Type of construction, locality, type of projects, type of investment in the first 3 months of 2022 updated in HOUSELINK data system.

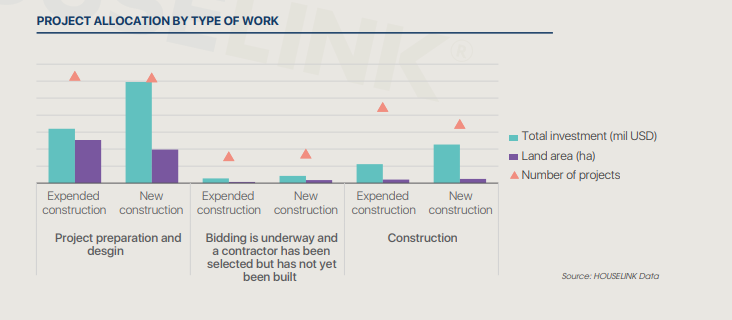

In the third quarter of 2022, projects under preparation and design stages accounted for the largest number and total investment among industrial projects. Due to the continuous increase of the cost of raw materials and fuel in recent years, leading to a great impact on construction costs, and the disruption of supply chains, which makes investors afraid to invest in projects.

According to HOUSELINK’s system data, we note that in terms of quantity, expansion projects and new construction projects are not too different, but the scale of investment capital of new construction projects is nearly double that of expansion projects (see more details in the chart below). This shows that investors tend to expand production but the scale is not too large. In addition, new construction projects have achieved high values in terms of both quantity and investment scale. The new investment trend in large-scale projects is still being maintain in the Vietnam.

This report is released in Vietnamese version, English version.