Bright prospects for FDI in Vietnamese property market

Bright prospects for FDI in Vietnamese property market. The property market in Vietnam has received increased FDI inflows during the past years. VIR talked with Savills Vietnam managing director Neil MacGregor about his assessments of these FDI flows and expectations for the property market in the year ahead.

Vietnam has been attracting foreign direct investment (FDI) for 30 years now. How would you assess the quality of FDI inflows during the last years?

Vietnam has been extremely successful at attracting high-quality FDI, with this investment primarily going into manufacturing and real estate projects. In the real estate sector, big Singaporean developers such as Keppel Land, CapitaLand, Sembcorp, and Mapletree have been significant contributors from the mid-1990s onwards.

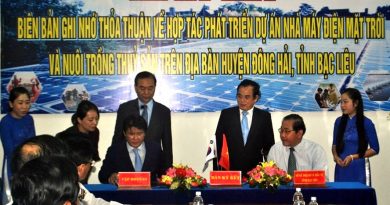

The next wave of significant investment came from Korea and developers such as GS E&C and Lotte continue to expand their presence to this day. There have been a number of successful Malaysian developers, including Gamuda and SP Setia, as well as other successful projects such as Park City in Hanoi.

More recently, we have seen growing interest from Japan, with Japanese investors now involved in everything from relatively small minority positions to enormous projects such as Sumitomo’s smart city joint venture with BRG. Other than manufacturing and real estate investment, it is important to note the contributions of the service sector as well.

What should the Vietnamese government do to attract high-quality foreign investment?

As participants in the real estate sector, we see the difficulties that foreign investors face when trying to invest in Vietnam. The reality is that land with legal title, which is available for development, is scarce in Vietnam and this holds back the ability of the real estate sector to contribute to the economy as much as can be seen in other countries.

The potential for the government to raise massive revenues from providing foreign investors easy access to land is clear for all to see. This comes in the form of land use fees, but also through tax revenues from the businesses that are developed on that land. The development of real estate can facilitate all kinds of additional benefits, including of course the development of much-needed infrastructure.

We hope that the government can assist with facilitating transparency, for the benefit of all foreign investors and ultimately leading to growing contributions by foreign investors to the sustainable growth of the Vietnamese economy.

How was the Vietnamese property market in 2019?

Vietnam has seen strong demand in 2019, in all segments from residential apartment, landed houses, office, and industrial property and hospitality. However, it has been very limited in supply. There has been a mismatch between demand and supply.

In some ways, Vietnam is missing the opportunity when the economy is so strong with strong GDP growth, investment, and consumer spending, but we have no real estate products to meet the demand from investors and occupiers.

The real estate sector has not performed to its full potential in 2019, it should have done much better. This is true for all segments. It is very difficult for office occupiers to find office space at the moment since there is very limited new supply under construction at the moment. In addition we also have not seen many new hotels, and there is very limited new warehousing, schools, and hospital developments under construction at the moment in CBDs.

The reason for the short supply is the stagnancy at projects waiting for local authorities to review them before letting them continue. I think that if this stagnation continues, it will impact the construction and real estate sectors and the whole economy. We start to see the impacts in the slowing real estate market and economic indicators.

It is important that authorities start to release projects in order to earn high tax revenue from the land use fee or from corporate income tax from those involved in property development or from apartment rental incomes. If the government does not encourage the growth of the real estate market, it will have an impact on the tax revenue of the city.

Being one of the first property consultants in Vietnam, how was business for Savills in 2019 and what do you expect in the year ahead?

2019 was a record year for Savills in Vietnam. We have performed particularly well in all advisory services such as market research, valuation services, and development consultancy services. Our residential sales team had a good year because of strong demand, but it had been held back by the lack of new supply. We have been fortunate to have some exclusive office leasing which are under construction like Friendship Tower in Ho Chi Minh City and in Capital Place in Hanoi. Those projects have been received very well by the market.

However, our biggest success story I must mention is about the property management portfolios. We now manage more than 40,000 apartments in about 80 projects. We have also rolled out our property management software which is used in almost all of our projects. We hope to develop more prop-tech solutions for the Vietnamese market in the future. We also would like to further expand our property management portfolios into office and retail projects.

All of those projects under Savills management are increasing their value whether they are residential or office developments. Projects under the management of Savills are increasing their capital gain and stronger rental growth. We have demonstrated the impact we can have in terms of high-quality property management.

It is very difficult to say what the market will be like in the next year and the ones after, without knowing whether projects are going to start and to be approved. Vietnam has huge opportunities. If the authorities can approve more projects, the demand is there at all levels from luxury to affordable apartments, to townhouses, shop houses, villas, and office space.

Source: Vir