Summary Report- Security & Fire Protection Equipment Industry And Investment Supply Chain In Vietnam – 7 Months 2024

The Gross Domestic Product (GDP) in the second quarter of 2024 saw positive growth, reaching 6.93% compared to the same period last year, slightly lower than the growth rate of 7.99% in the second quarter of 2022 within the 2019-2024 period. Notably, the industry and construction sector showed good growth (about 8.29%, with the industry alone increasing by 8.55%), which is also much higher than the scenario outlined in Resolution 01/NQ-CP (6.6%). Overall, the GDP growth for the first six months of 2024 was 6.42%, slightly lower than the 6.58% growth rate in the first six months of 2022. It is forecasted that Vietnam’s economy in 2024 could achieve a fairly positive growth rate, with GDP growth projected to be in the range of 6%-6.5%.

Inflation pressure increased in the first seven months of 2024, with the Consumer Price Index (CPI) in July rising by 4.36% and core inflation increasing by 2.61% compared to the same period last year. Overall, in the first seven months of 2024, the average CPI increased by 4.12%, and average inflation rose by 2.73% compared to the same period last year.

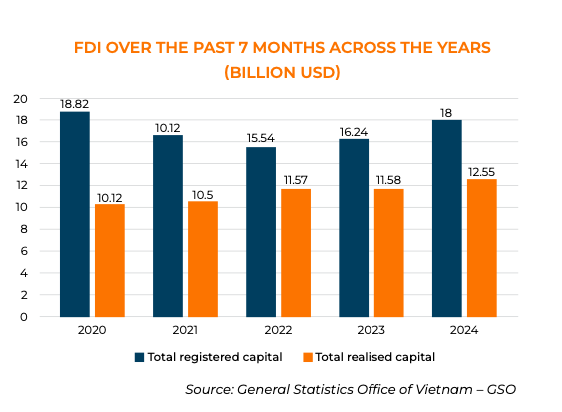

As of July 2024, total FDI (Foreign Direct Investment) capital reached over 18 billion USD, an increase of 10.9% compared to the same period in 2023. At the same time, total implemented capital reached 12.55 billion USD, an increase of 8.4% compared to the same period last year. This is the highest implemented capital in the first seven months of the year in the past five years.

The IIP (Index of Industrial Production) of the manufacturing sector in the first seven months of 2024 increased by 8.5% compared to the same period last year, marking a significant recovery after a 0.8% decline in the first seven months of 2023, and just slightly below the 8.6% growth of 2022. This improvement is clearly reflected in the Purchasing Managers’ Index (PMI) for Vietnam’s manufacturing sector, which remained at 54.7 points in July, compared to 50.3 points in May and April.

Vietnam’s Security & Fire Protection Equipment Market

Security equipment import and export data in this report focuses on surveillance cameras, video recorders, warning lights/siren and access control gates.

Security equipment imports fluctuated significantly from 2019 to 2023. Imports increased sharply in 2020 and 2022, with growth rates of 37% and 36%, respectively, but decreased in 2021 (down 20.4%) and in 2023 (down 11.4%). Although imports decreased in 2023, the value remained higher than in 2019 and 2021. Surveillance systems (surveillance cameras and video recorders) were the most imported items, accounting for 85% of the total import value of security equipment into Vietnam. Products such as warning lights/sirens and access control gates accounted for a smaller share of about 15%. Vietnam primarily imported security equipment from China, which accounted for 77% of the import value, followed by Sweden, South Korea, and Italy.

Situation of the supply chain of Security and Fire protection equipment investment in Vietnam

The Security equipment supply chain

In the period of 2013 – 2024, the projects of security equipment supply chain are showing a good growth trend. This growth is particularly evident in the project attraction situation from 2015 to 2019, with the peak occuring in 2019, when the number of project reached an impressive figure (42% increase compared to 20218). In terms of project quantity, after a decline due to the impact of the Covid-19 pandemic, by 2023, security equipment projects had a notable recovery, reaching nearly 5 times in the number of projects compared to the same period in 2022.

The supply chain of fire protection equipment

In terms of the supply chain of fire protection equipment, the raw materials are the largest segment (about 55% of total projects). Followed by manufacturing and assembly projects, which make up roughly 1/3 of annual investment projects, with over 60% of these coming from DDI. Additionally, component projects account for 13%, while auxuliary material projects make up 4%. Regarding the investment types, DDI is the largest source of funding at 21%, followed by Korea, China, Taiwan and Japan.

The attracting industrial FDI projects situation in Vietnam

In the first six months of the 2020 – 2024 period, the attraction of FDI projects has shown a positive growth trend. Although FDI project growth slightly decreased from 2020 to 2022 due to external factors, there was a notable recovery in the first half of 2023, with an increase of approximately 57% compared to the same period previous year. This growth peaked in the first half of 2024 with 554 projects (an increase of 47% compared to the first half of 2023). These positive figures demonstrate that Vietnam is an ideal destination for industrial investment projects. With the improved investment conditions, enhanced infrastructure capabilities and strong investment attraction policies have made industrial investment a bright spot in Vietnam’s economy.

According to the Draft Law on Industrial Parks and Economic Zones in Decision No. 7304/BKHDT-QLKKT, Vietnam is orienting towards encouraging the development of various types of eco-industrial parks, specialized industrial parks and High-tech industrial parks in the near future. Particularly, in its latest communication to the People’s Committees of centrally governed provinces and cities, the Ministry of Planning & Investment emphasized tightening governmental oversight over industrial park investments.

According to Official Letter No. 4907/BTC-CST on tax policies for the manufacturing and assembly of fire protection equipment: Fire trucks have an import tax rate of 3%, while fire-resistant clothing has a tax rate of 5%.

As of the end of July 2024, Vietnam has established comprehensive strategic partnerships with seven countries: China (2008), Russia (2016), Korea (2022), USA (09/2023), Japan (11/2023) and Australia (2024). At the Vietnam – US investment and innovation conference, the US announced several new initiatives to enhance future partnership. Notably, the development of the Development of Electronic and Advanced Technology partnership (DELTA) network was highlighted. This agreement is expected to boost the export of electronic components from Vietnam to US, including those related to security and safety. This will facilitate Vietnamese electronics manufacturers in expanding their exports to the US market in the near future.

In 2023, Vietnam’s average population reached 100.4 million people. The population growth rate is trending downward as the birth rate has decreased in most provinces in recent years. It is forecasted that by 2029, Vietnam’s population will be around 104.5 million, entering a phase of slowing population in the working-age group (66.6 million people). Among these, over 63% are aged 25 to 49, an age range characterized by work experience and strong professional skills.

Here you can access reports on Vietnam’s construction market and industry investments.

Please sign up to receive periodic reports by filling up the form below.

Source: HOUSELINK