Summary Report – Industrial Equipment & Machinery Industry And Investment Supply Chain 2024 in Viet Nam

In 2023, the situation of attracting FDI significantly improved compared to the period from 2020 to 2022. Despite being a year marked by high inflation in many countries, FDI into Vietnam increased by 32.1% compared to 2022, reaching $36.6 billion USD. Particularly, realised capital reached the highest

level in 5 years, at $23.2 billion USD. In the first four months of 2024, FDI attraction has shown strong growth.The total registered capital in the first four months reached $9.3 billion USD (up 4.5% compared to the same period last year), and the total realised capital reached $6.3 billion USD (up 7.4% compared to the same period in 2023).

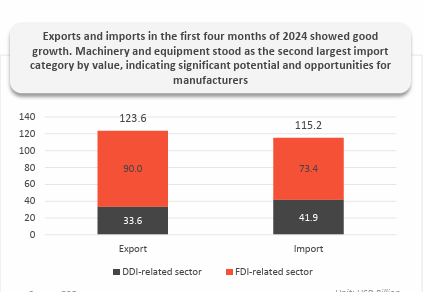

After a period of decline in import-export value due to reduced orders and significantly decreased consumption demand in major countries, Vietnam’s exports and imports both recorded good growth in the first four months of The trade balance of goods achieved a surplus of $8.4 billion USD. The United States, China, and Europe remain the main export markets for Vietnam in the first four months of 2024, with the highest export growth to the United States.

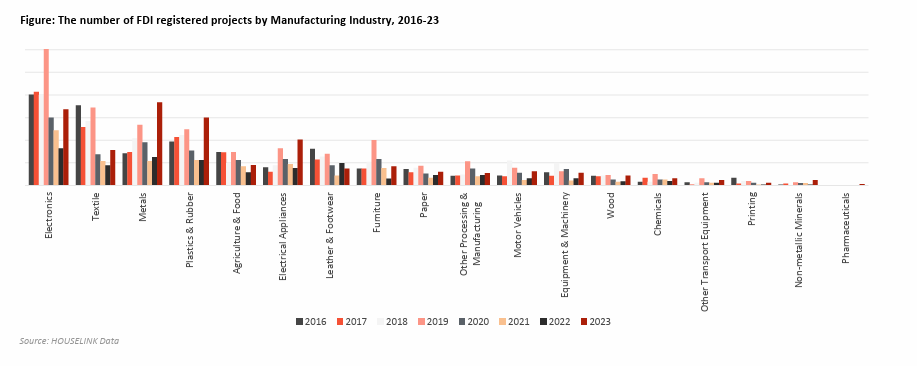

Vietnam has witnessed a growing number of investment projects in manufacturing, with both foreign and domestic investment trends on the rise, especially in key industries such as electronics, metals, plastics-rubber, etc. This reality boosts the demand for machinery and equipment, particularly in the

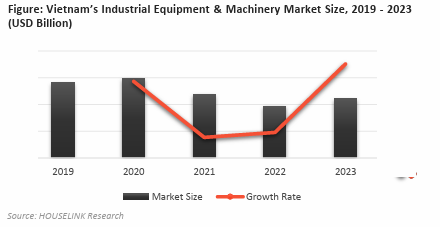

industrial manufacturing sector. The market value of machinery and equipment in Vietnam in 2023 saw a slight decrease compared to 2022. The Vietnamese machinery and equipment market peaked in 2020 with an estimated market value of around $92.6 billion USD (a significant increase from 2019). However, it faced a sharp decline afterward. According to our research, the substantial increase in the market value in 2020 was mainly due to the prices of machinery and equipment globally being affected by the disruptions in supply chains caused by the Covid-19 pandemic (in 2020, the estimated average value of machinery and equipment increased compared to 2019).

In 2023, despite the overall decline in the machinery and equipment market volume, the industrial machinery and equipment segment recorded an increase compared to 2022, driven by increased investment momentum from manufacturing projects in Vietnam during that year. Moving into 2024, the

significant increase in investment attraction for manufacturing projects, both FDI and DDI, in the first four months of the year serves as a major driver for the industrial machinery and equipment market.

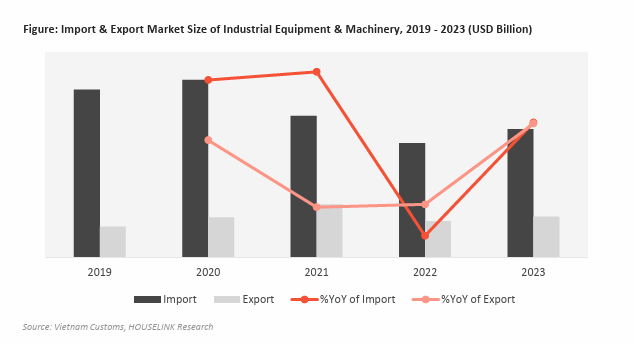

In reality, the data shows that imports of industrial machinery and equipment into Vietnam are trending downwards. However, this trend is mainly influenced by external economic movements impacting import demands. Importation decreased in 2021 and 2022, but in 2023, there was a turnaround with imports beginning to grow again (increasing compared to 2022). Although import values remain lower than pre-pandemic levels, the slow recovery of the global and Vietnamese economies suggests potential market recovery in Vietnam’s industrial machinery and equipment sector. Despite the high volume of imports, the value of Vietnam’s exports of industrial machinery and equipment remains relatively low compared to imports. On average, the export value is only about 30% of the import value. Export trends showed growth during the 2019-2021 period, with 2021 recording the strongest export growth in 5 years (increasing compared to 2020). Exports decreased significantly in 2022 due to reduced demand, but export values remained higher than in 2019. In 2023, exports also showed signs of recovery, increasing compared to 2022.

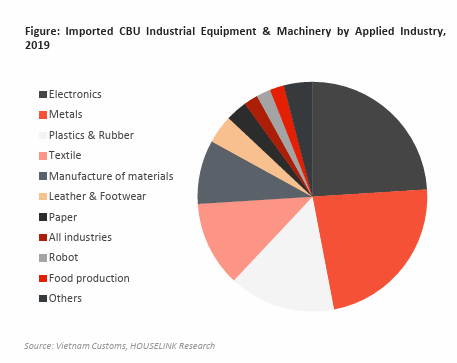

For the import market of industrial machinery and equipment, completely built up (CBU) machines constitute a high proportion (often accounting for over 80% of the total import value of industrial machinery and equipment). Therefore, they share the same trend with the overall industrial machinery and equipment sector. CBU machines also showed a slight recovery in both exports and imports

in 2023 after a period of decline during the pandemic.

Alongside industries such as electronics, metals, plastics & rubber consistently ranking top in market share for industrial machinery and equipment, the import of robots is showing a rapid upward trend year by year. In 2019, robots ranked only 9th in terms of import market share, but by 2023, robot imports climbed to 5th place, surpassing traditional industries such as textiles, paper, and leather & footwear.

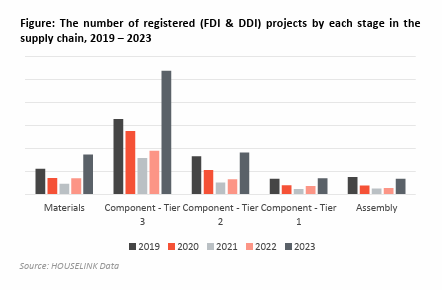

It can be observed that, in terms of project quantity, all stages in the Machinery and Equipment supply chain share a common pattern: a significant decrease during the period from 2019 to 2021, followed by recovery in 2022 to 2023.

• During the period from 2019 to 2021, the number of projects recorded a decline each year and hit a bottom in 2021 due to the negative impacts of the pandemic in Vietnam and key investing countries such

as China, South Korea, and Japan.

• The period from 2022 to 2023 has shown recovery across all stages. The number of projects in 2023 saw a significant increase, surpassing the pre-pandemic level of 2019 in the Materials and Components

stages- Tier 3, 2, and 1. However, the Assembly stage indicated a slower recovery compared to the 2019 level.

Maintaining the growth trend in investment during the period 2016- 2019 and rebounding after the pandemic, the electronics, plastic & rubber, metal and metal products, furniture, other processing and manufacturing, motor vehicles & other transport vehicles, machinery & equipment, and chemicals industries are expected to continue this objective trend in the coming years. During the period 2020- 2021, the economy and FDI inflows, along with investment situations in manufacturing sectors in particular, experienced a downturn due to the negative impacts of Covid-19 in Vietnam and investing countries. This sharp decline is attributed to external factors, thus it does not reflect a long-term downward investment trend.

Here you can access reports on Vietnam’s construction market and industry investments.

Please sign up to receive periodic reports by filling up the form below.

Source: HOUSELINK