INDUSTRIAL PARK REAL ESTATE DEVELOPMENT IN VIETNAM – H1 2025

OVERVIEW OF VIETNAM MACROECONOMIC H1 2025

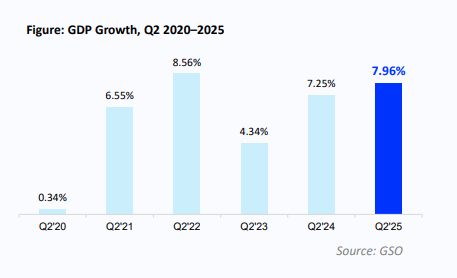

Vietnam’s economy grew by 7.96% in Q2 2025 compared to the same period in 2024 — the second-highest quarterly growth rate between 2020 and 2025, trailing only the 8.56% growth of Q2 2022. Given the evolving and challenging economic landscape of 2025, the 7.96% growth rate is considered positive. For the first half of the year, GDP growth reached 7.52%, the highest H1 growth rate recorded in the 2011–2025 period. However, in order to meet the annual growth target of 8% or higher, pressure will remain on the economy to maintain strong momentum in the remaining two quarters of the year.

Notably, the foreign-invested sector has accounted for an average of 72% of Vietnam’s total export value, and this share is showing signs of continued expansion. This confirms that exports — one of Vietnam’s core growth variables — are largely dependent on the FDI sector.

ANALYSIS OF INDUSTRIAL INVESTMENT ATTRACTION SITUATION

- Overview of Industrial Investment Attraction Situation

Period 2017 – 2020: Surge driven by the US–China trade war. Notably, in 2018 and 2019, when the US – China trade war officially began, the number of industrial FDI projects and total capital experienced significant growth.

In 2018: up by 10.2% and 23.8%, respectively

In 2019: up by 23.4% and 30.5%, respectively

Period 2021–2024: Remarkable post-pandemic investment recovery. Investment attraction during this period was heavily impacted by the COVID-19 pandemic, combined with ongoing tensions from the US – China trade war.

Period 2025 – Expected 2028: Resilient amid protectionism and tariffs. Despite the instability caused by the trade and investment policies of the world’s largest economy, the number of investment projects in Vietnam during the first five months of 2025 still grew.

Vietnam’s industrial FDI landscape is evolving. Mid-sized projects are emerging. From 2022 to the first five months of 2025, factory leasing has shown an expanding trend, land leasing is shrinking in share, but remains the dominant model.

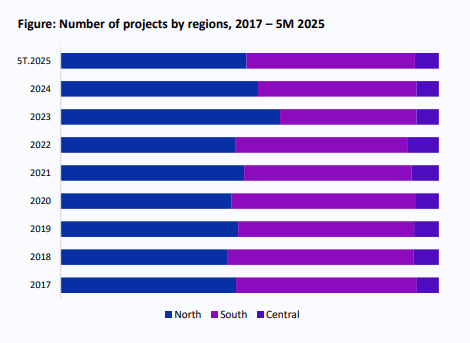

Northern and Southern Vietnam lead industrial FDI attraction both in terms of project numbers and total investment, as these two regions also host the largest number of operational industrial parks nationwide.

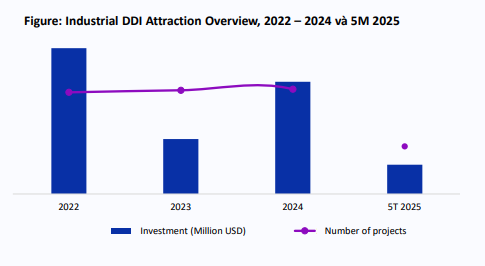

Industrial DDI attraction during the 2022–2025 period has maintained a positive growth trajectory, albeit at a relatively slow pace, especially in terms of capital.

Investment flows concentrate on sectors that support production infrastructure and show strong domestic market potential.

- Analysis of Industrial FDI Investors

In this in-depth analysis of the FDI investor segment, we use data on industrial FDI projects in Vietnam from 2022 to the first 5 months of 2025, categorized into four main investment capital tiers:

➢ Below 2 million (M) USD segment accounts for the majority of warehouse lease

➢ From 2 – Below 10M USD segment shows steady growth in both number of projects and investment value – indicating Vietnam’s continued appeal to mid-sized manufacturing projects – though this segment’s growth rate has also begun to decelerate.

➢ From 10 – Below 50M USD segment have seen growing interest since 2022, though the growth rate has slowed

➢ From 50M and above (The large to very large capital segment) has recently shown signs of slowing down.

- Analysis of Industrial DDI Investors

In this in-depth analysis of the FDI investor segment, we use data on industrial FDI projects in Vietnam from 2022 to the first 5 months of 2025, categorized into 3 main investment capital tiers:

➢ From 2 – Below 10M USD: In 2022–2024 period, this segment showed an upward trend in both total investment and number of projects. Specifically, the first 5 months of 2025 saw a 16.7% rise YoY. However, the growth rate of total registered investment remained modest, indicating a notable decrease in project size.

➢ From 10 – Below 50M USD: The period 2022 – 2024 saw a declining trend in this segment. However, entering 2025, this segment has shown positive signs of recovery.

➢ From 50M and above: This segment has shown a strong recovery and a clear rebound.

KEY DRIVERS AFFECTING INDUSTRIAL INVESTMENT ATTRACTION

- Domestic Factors

Plentiful IP land supply as a highlight for attracting investment

Plentiful IP land supply: highlight to attract investment

Series of large-scale connectivity infrastructure projects are being accelerated

Accelerate the streamlining of organization and decentralization of management

Electricity growth slowing down compared to GDP growth

- Foreign Factors

Vietnam has a favorable geographical location and strong regional potential

Volatile international commerce environment

What can Vietnam do to effectively attract new wave of investment?

➢ Effectively Leveraging Industrial Land Supply

➢ Enhancing Localization and Reducing Dependence

➢ Focusing on Key Industries with Native Advantages

ANALYSIS OF INDUSTRIAL PARK INFRASTRUCTURE

- Overview of Current Landscape of Operational Industrial Parks

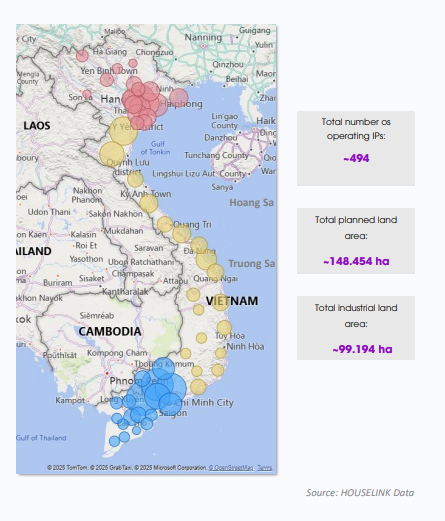

The supply of operational IP is abundant and stable

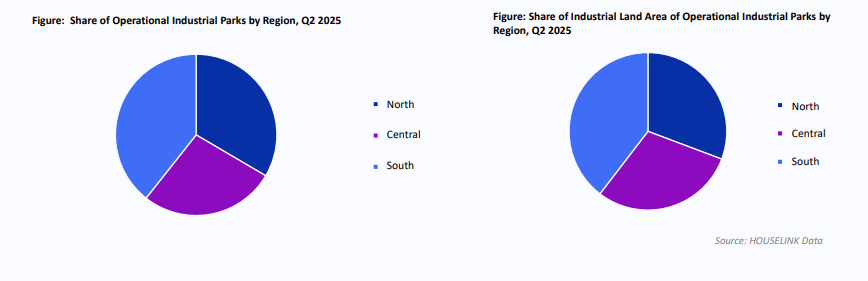

The South leads in both the number and total area of operational IPs

- Occupancy Rate & Vacant Land Area

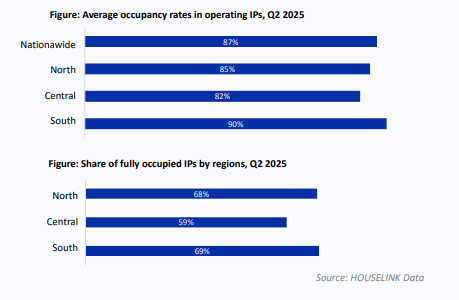

High average occupancy rate of IPs nationwide. Based on a survey conducted by HOUSELINK on 272 operating IPs, benefiting from geographic advantages, connected transportation infrastructure, and a high level of economic and industrial development, the Southern region currently leads the country in IP occupancy rates, with 68% of surveyed IPs fully occupied. The North closely follows with the same 68% occupancy rate, while the Central region lags behind at approximately 59%.

As of the end of Q2 2025, the available vacant industrial land totals approximately 10,322 ha. With this substantial supply capacity, the industrial park market is well-positioned to meet production demands in the second half of 2025.

- Overview of Industrial Park Infrastructure and Utilities

One significant advantage of domestic IPs is their excellent transport connectivity. Statistics show that up to 67% of IPs are developed adjacent to national highways. According to our recorded data, nearly 50% of IPs have factories that have installed rooftop solar power systems. This indicates that investors are increasingly prioritizing the use of renewable energy sources as a gradual replacement for national grid electricity, moving toward green manufacturing standards and sustainable industrial parks.

Utility infrastructure has seen considerable improvement, as services such as supermarkets, hospitals, customs offices, and fire protection are now located relatively close to many IPs. Moreover, some IPs have even integrated these facilities directly within the park itself. This greatly contributes to attracting labor and ensuring better daily living conditions for workers.

- Trends in Rental Prices of Industrial Real Estate Types

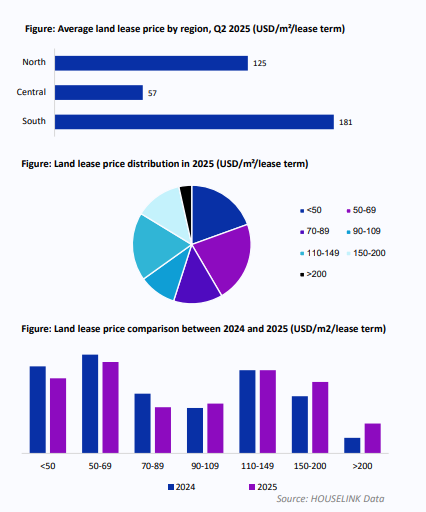

Land rents keep rising, shifting toward high-end segments, Southern Vietnam is taking the lead

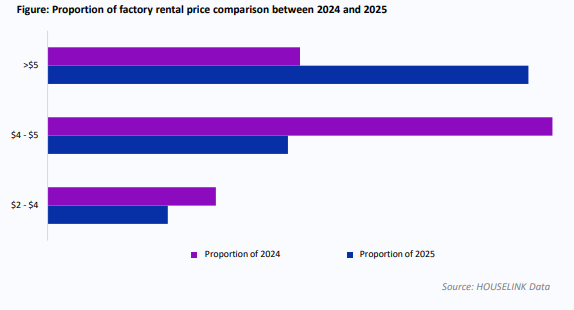

According to survey data from key IPs, factory and warehouse rents surge in high-end segment. This trend reflects the increasing demand for factory rentals and also indicates improvements in infrastructure quality and technical standards of factory products on the market.

Read the summary report here!

Here you can access reports on Vietnam’s construction market and industry investments.

Please sign up to receive periodic reports by filling up the form below.

Source: HOUSELINK