Summary Report – Status Of Industrial Projects Implementation In Vietnam Quarter IV / 2024

Gross Domestic Product Growth – GDP Growth

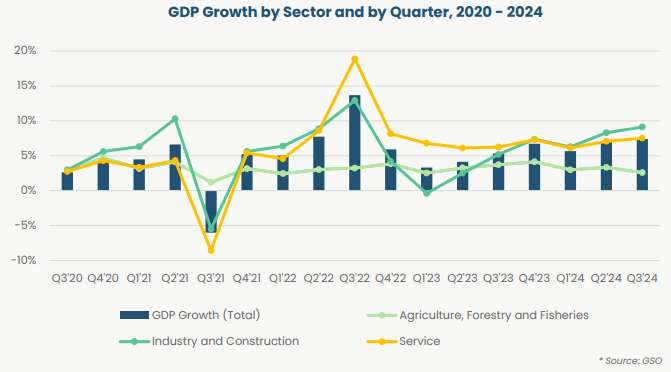

GDP Vietnam’s GDP in Quarter III of 2024 increased by 7.4% compared to the same period in 2023. In the first 9 months of 2024, GDP grew by 6.82%. These are noteworthy figures, despite the economy being heavily impacted by Typhoon Yagi and the global economic challenges, such as inflation and high interest rates. The economic and social situation in the first 11 months of 2024 has maintained a positive trend, with many sectors and industries achieving significant results, contributing to overall economic growth for the year.

In particular, the industrial and construction sectors experienced the strongest growth, with a 9.11% increase in Quarter III of 2024 and an 8.19% growth in the first 9 months of 2024 compared to the same period in 2023. This reflects a strong recovery in production and business activities in Vietnam following the impacts of the Covid-19 pandemic.

Foreign Direct Investment Attraction – FDI

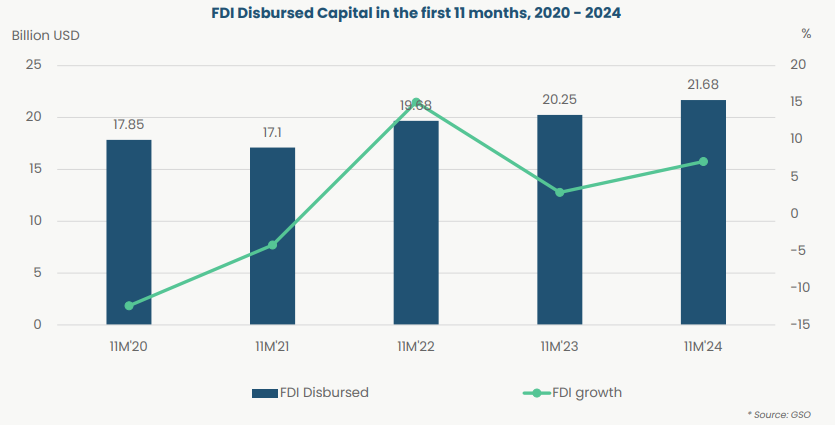

Foreign direct investment attraction in Vietnam continues to be a standout feature in the country’s economic landscape. In the first 11 months of 2024, FDI inflows reached 31.38 billion USD, placing Vietnam among the top 15 developing countries with the largest FDI flows in the world. Foreign investment disbursed in Vietnam totaled 21.68 billion USD, the highest level since before the COVID-19 pandemic, marking the third consecutive year of record-breaking figures. The FDI growth rate in frist 11 months reached 7.1% YoY, maintaining a strong momentum, which indicates that Vietnam is still on the right growth trajectory.

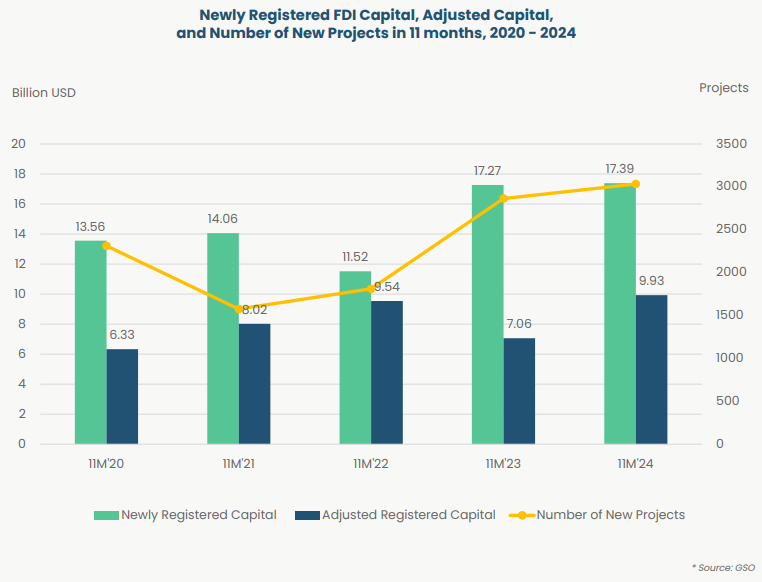

According to the report from the General Statistics Office, in the first 11 months of 2024, Vietnam registered 3,035 new FDI projects, with a total registered capital of 17.39 billion USD. Compared to the same period in 2023, the number of projects increased by 1.6%, and the registered capital grew by 0.7%. Although there wasn’t strong growth, these figures still indicate that Vietnam’s economy continues to maintain its attractiveness to foreign investors.

Import and Export Situation

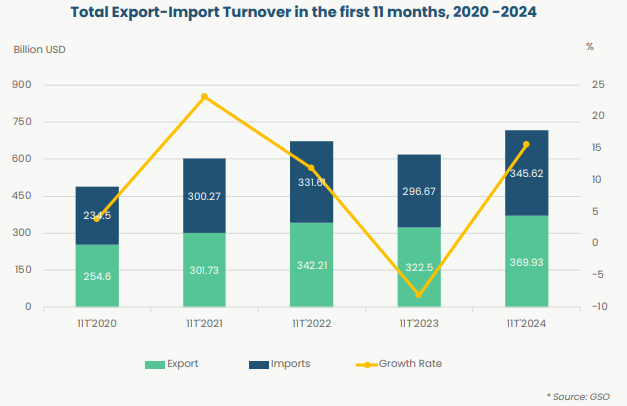

According to the General Statistics Office, in November 2024, Vietnam’s preliminary export-import turnover reached 66.4 billion USD, a decrease of 4.1% compared to October. However, in the first 11 months of 2024, the total export-import turnover of Vietnam rebounded strongly, reaching 715.55 billion USD, an increase of 15.4% compared to the same period last year. Of this, exports grew by 14.4% and imports increased by 16.4%. The higher growth in imports compared to exports indicates that businesses are ramping up preparations for production plans for the end of 2024 and the New Year 2025.

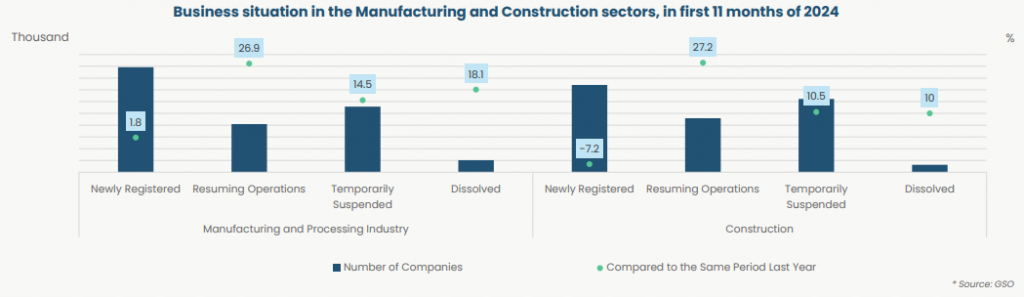

Situation of Enterprises in the Manufacturing and Processing Industry and Construction Sector

In the first 11 months of 2024, Vietnam’s manufacturing sector recorded a modest increase of 1.8% in the number of newly registered businesses, while the number of businesses ceasing operations and dissolving remained high, with increases of 14.5% and 18.1%, respectively, compared to the same period in 2023. This unfavorable situation can be attributed to challenges such as order shortages, access to capital, rising input costs, and supply chain disruptions caused by recent geopolitical instability.

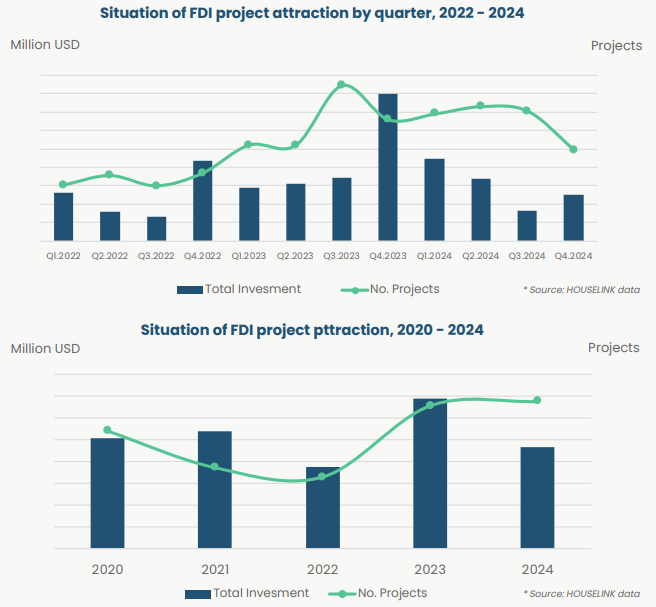

Overview of Investment Attraction Situation

Although Vietnam’s overall FDI attraction has seen growth in the first 11 months of 2024, a deeper analysis of newly registered FDI projects involving factory leasing or industrial land leasing reveals a different picture. Q4/2024 witnessed a sharp decline in both the number of projects and total investment. Specifically, the total investment in this period dropped by 68.7%, less than one-third of the same period last year. Compared to Q3/2024, the number of projects also decreased significantly (down by 30%), although the total investment showed a notable improvement of 54%. This indicates that the scale of FDI projects attracted in Q4/2024 is considerably larger than in the previous quarter.

For the entire year of 2024, the number of projects reached the highest level in the past five years, increasing by 3% YoY. However, in terms of total investment, the data shows a significant decline (down 32% compared to the same period last year), and it is only higher than the total investment in 2022.

Compared to Q4/2023, the FDI investment in factory leasing and industrial land leasing in Vietnam in Q4/2024 is quite bleak. None of the three regions experienced growth in the number of projects, with the North seeing a decrease of 43.3%, the Central region down by 5.8%, and the South unchanged (0%). For the entire year of 2024, the North decreased by 7.4%, the Central region increased by 6.8%, and the South continued to see significant growth at 18.6%. Overall, the decline in the North after a strong performance in 2023 reflects a cooling in the growth rate, while the South emerged as the region with stronger growth in 2024.

In terms of quarterly growth, the FDI project numbers in the North and South saw a sharp decline in Q4/2024 compared to Q3/2024, with the North and South decreasing by 33% and 35%, respectively. In contrast, the Central region recorded a strong growth rate of 46%.

Here you can access reports on Vietnam’s construction market and industry investments.

Please sign up to receive periodic reports by filling up the form below.

Source: HOUSELINK