FTAs lay the groundwork for industrial zones nationwide

Vietnam has entered the global economy via a range of free trade agreements, some already signed, and others expected to be signed in the near future. Chi Tran, research manager at Cushman & Wakefield Vietnam, explains her forecast for the development of industrial property in this particular context.

Currently, Vietnam has 299 established industrial zones (IZs) with the total land area of nearly 84,500 hectares, 66 per cent of which is leasable. 212 of these 299 IZs are already in operation; the remaining 87 are still in the process of site clearance and compensation or basic construction.

Currently, Vietnam has 299 established industrial zones (IZs) with the total land area of nearly 84,500 hectares, 66 per cent of which is leasable. 212 of these 299 IZs are already in operation; the remaining 87 are still in the process of site clearance and compensation or basic construction.

The south-east region has the most IZs in Vietnam, with nearly 100 projects (32.8 per cent of all IZs), followed by the Red River Delta with 76 projects, and the Mekong River Delta with 51 projects. Key cities and provinces with active IZ development include Dong Nai, Binh Duong, Ba Ria-Vung Tau, Ho Chi Minh City, Long An, and Bac Ninh.

As of the end of December 2015, there was expected to be 304 established IZs out of 463 planned IZs nationwide, among which 43 projects are financed with foreign investments and 259 others are domestically developed, with the total registered capital of $3.58 billion and VND191 trillion, respectively.

Notably, investment capital from domestic developers has significantly increased in recent years, up 16 per cent in the number of investment projects, and up 72 per cent in the amount of capital compared to 2010. For foreign developers, there has been a 13 per cent increase in the number of projects and a 24 per cent increase in the total investment capital compared to 2010.

The total implemented capital invested in IZ infrastructure accumulated by December 2015 increased to around $2.5 billion (equivalent to 70 per cent of the total registered foreign capital) from foreign sources and VND87 trillion (equivalent to 46 per cent of the total registered domestic capital) from domestic investors.

Industrial zones will be the most effective way for Vietnam to capitalise on the benefits of free trade agreements-Photo: Le Toan

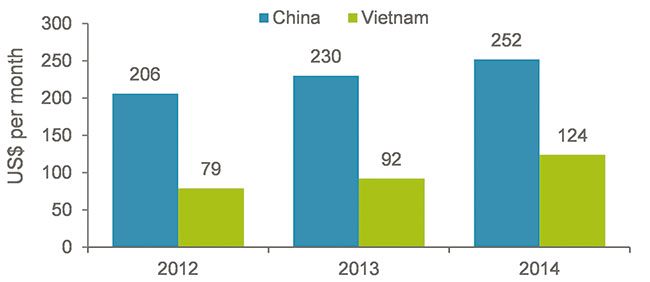

Vietnam is an attractive location for investment, as indicated by the increasing amount of foreign direct investment capital pouring into the country in recent years. Along with stable economic conditions and favourable government policies, the low cost of labour relative to other countries is a major factor that helps Vietnam draw more and more capital from foreign manufacturers.

Additionally, due to the Trans-Pacific Partnership (TPP) and other free trade agreements (FTAs) that Vietnam has ratified in recent years, many manufacturers will likely shift their operation to Vietnam to receive tax benefits. The demand for industrial land as well as warehouses and factories is therefore on the rise, making industrial real estate a promising investment channel.

Moreover, favourable policies from local authorities help attract investment in IZs. For example, IZ developers receive the lowest rate for land leasing, as well as tax exemptions, and various types of financial support from local authorities. The government is also making great strides in improving infrastructure as well as developing logistics services, which will aid the development of industrial real estate in the near future.

As a result of the TPP, in the next decade Vietnam’s GDP is expected to rise by 11 per cent, or $36 billion. Exports have been forecast to increase by 28 per cent in the same period as companies move factories to Vietnam to benefit from lower labour costs as well as favourable tax policies.

The TPP is expected to boost investment particularly from the main importers of Vietnam’s products, such as the US and Japan. Investment from US companies is still limited compared to regional peers Korea and Japan. US companies will likely increase manufacturing operations in Vietnam and re-import Vietnamese products due to the tax exemptions on major products such as textiles. These companies may focus on IZs in the southern provinces of Vietnam, where many existing textile companies are located.

Likewise, manufacturers from other countries will certainly consider shifting their factories from non-member countries of the TPP such as China, Thailand, Cambodia, Indonesia and India to Vietnam to benefit from the lower tax rates. This will increase the demand for industrial land, warehouses, and factories, not only from member countries of the TPP but also from other outsiders such as China, Hong Kong and Taiwan.

IZs have great potential for development as a result of the favourable socio-economic situation. With the competitive advantages of abundant and cheap labour sources, as well as the potential purchasing power of a young population, Vietnam remains very attractive to international manufacturers.

A recent study by Standard Chartered Bank showed a shift of investment from China to the ASEAN community in a bid to capitalise on the upcoming TPP. 44 per cent of respondents said they would choose Vietnam for its large domestic market, 29 per cent for its lower operational costs, and 18 per cent for the ample labour supply.

In addition, The Regional Comprehensive Economic Partnership (RCEP) and the ASEAN Economic Community (AEC), of which Vietnam and Singapore are members, also facilitate bilateral investment opportunities.

An example of the potential within the Vietnamese IZ market was illustrated by Microsoft, which has recently closed its two Nokia plants in China to relocate to Vietnam. The company is reportedly expanding its $210 million plant in the northern province of Bac Ninh and tripling its current head count of 5,000. With an increase in labour and operational costs in China, Vietnam benefits from the commercial and industrial enterprise exodus from China, which creates a lot of room from industrial real estate development.

The outlook for IZ development is excellent. From now until 2020, there will be a total of 104 newly-established IZs and 26 expanded IZs spread throughout Vietnam, which will attract over 6,500 projects totalling $45-$50 billion, of which there will be 50 per cent implemented capital and approximately 2.1-2.2 million labourers.

By the year 2020, the main goal is to complete the IZ network in Vietnam, developing a total land area of 120,000ha and pushing the industrial value in IZs to 25 per cent of overall GDP. To achieve this goal, a decisive IZ network must be established that will create IZs of a suitable scale to develop industrial sectors, thus transforming the economy in localities where there is a low ratio of industry in GDP.

One of the largest headaches for any firm coming to Vietnam is recruitment and logistics. By their very nature, hi-tech industries need a well-educated workforce, and finding and training the right people takes time and money. In addition, finding the right suppliers can also cause many problems and until supply chains are established in-country, many parts will have to be manufactured elsewhere and shipped in.

Once these initial issues are addressed, companies will think about scalability, i.e. ask whether they are in a position to rapidly increase production to take advantage of any new markets that suddenly become possible. Again, this will involve a cost effective local logistics network being integrated into the global network. Manufacturers will need to understand these issues now in order to successfully take advantage of any new markets once the TPP is ratified.

Source Vir