Vietnam’s Construction Industry Overview 2019 – Events and Figures

2019 – a pivotal year that clearly marks the “mature” period of construction industry’s growth rate. Compared to the forecast of the deceleration of the construction market and the “10-year cycle curse”, 2019 seems to have passed quite smoothly. Up to now, the construction market has followed a completely different movement trajectory, though, there was a period of volatility.

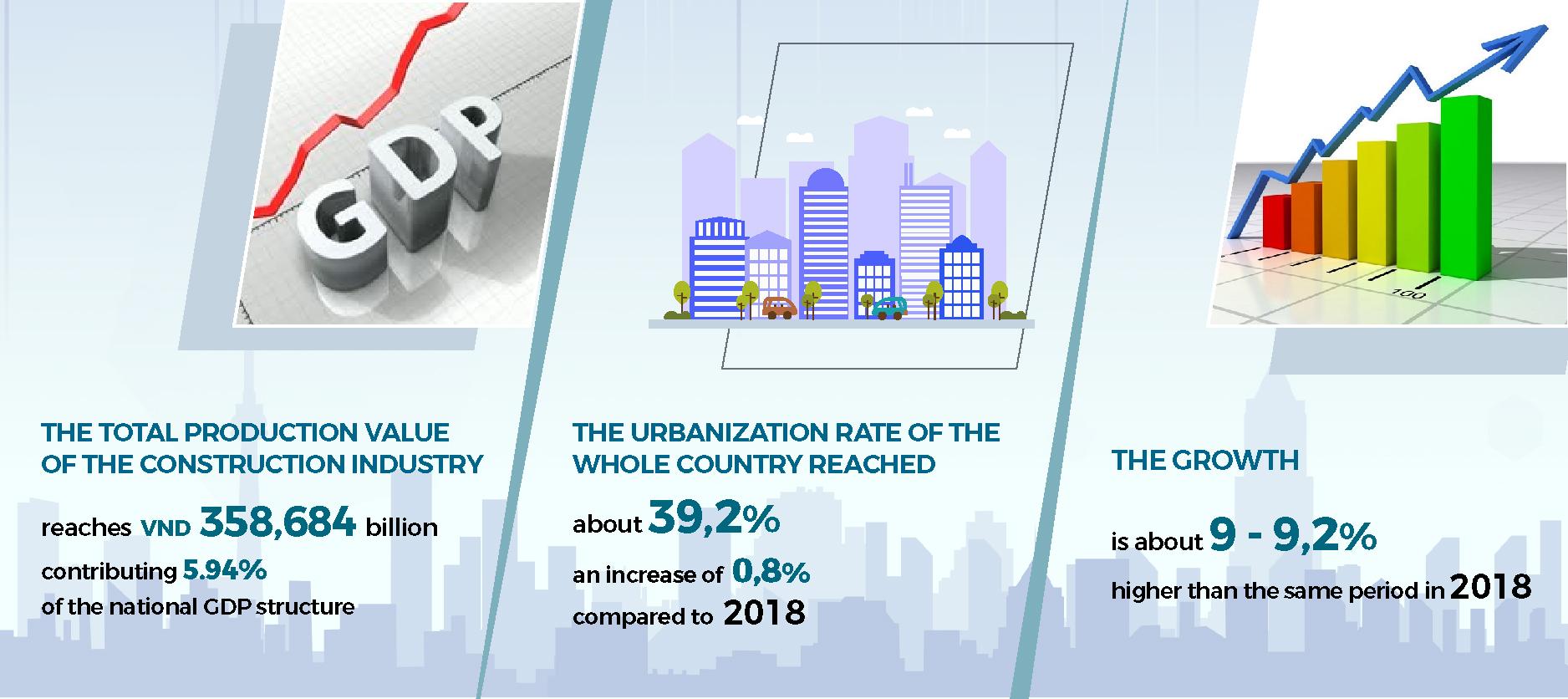

The report evaluating the performance of tasks in 2019 issued by the Ministry of Construction showed that construction activities grew by about 9 – 9.2% over the same period in 2018. The rate of urbanization nationwide reached about 39 , 2%, up 0.8% compared to 2018. Specifically, the total production value of the whole construction industry reached 358,684 billion VND, contributing 5.94% of the national GDP structure.

By the end of 2019, the construction industry is showing signs of a shift of “quality growth” to “maturity” in its life cycle. The industry outlook is evaluated to be “Cautious short-term, long-term optimism” in the context of the bright growth of industrial construction along with the flow of foreign investment capital and the attraction of moving factories of large corporations in China to Vietnam.

HOUSELINK would like to introduce the overall picture of the construction industry in 2019 on each value in the construction industry chain.

1.Residence and Commerce Construction

In 2019, the total housing area increased by about 50 million m2 of floor, of which low-price housing have 4,110 units with a total area of 205,000 m2 of floor.

In 2019, the total housing area increased by about 50 million m2 of floor, of which low-price housing have 4,110 units with a total area of 205,000 m2 of floor.

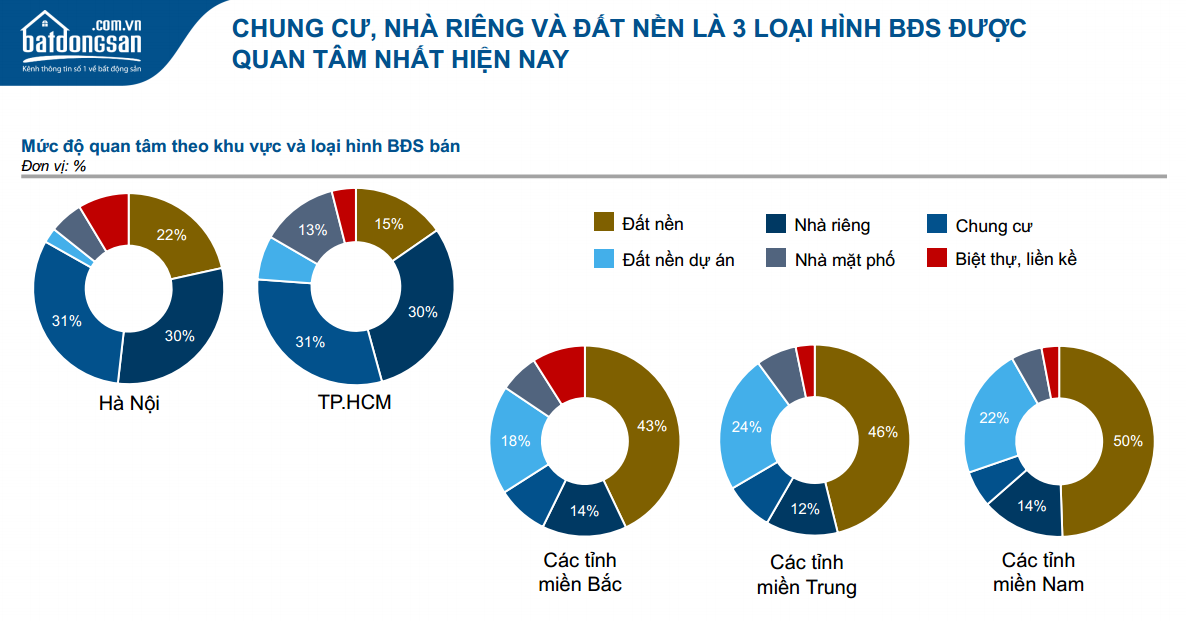

According to the market research report released by Batdongsan.com.vn in early December 2019, the number of posts of all types of real estate in 2019 increased by 42% compared to 2018 and the interest of Vietnamese real estate buyers also increased by about 2.8%. In particular, apartments, houses and land are currently three most interested types of real estate.

In addition to key markets such as Hanoi and Ho Chi Minh City, 2019 also witnessed an increase in interest index compared to 2018 in markets such as Hai Phong (up 38%), Quang Ninh (up 91%), Lam Dong (up 71%), especially the real estate market in Binh Thuan with people’s concern rising to 153%.

The demand for housing is still very large.

According to the 2019 Census of Population and Housing, Hanoi currently has about 8 million people with an average housing area of 26.1 m2 / person. Meanwhile, the population in Ho Chi Minh City is nearly 9 million people with an average housing area of 19.4 m2 / person. The total area of housing needed each year in Hanoi is about 4.7 million m2, in Ho Chi Minh City is about 4 million m2.

With an average population growth rate of about 2.2% in both Hanoi and Ho Chi Minh City, the demand for housing construction in these two cities is assessed to be very large.

Another particular characteristic of the housing construction market in 2019 is the product structure imbalance. Typically, the Ho Chi Minh City market loses its supply of products with cheap and affordable prices. According to the Ministry of Construction’s Summary of Activities report, out of the 8 targets set for 2019, only the target of social housing fails to meet the plan, of which there are 4,110 units of social housing with a total area of 205,000 m2. (The planned target is 50,000 units with a total area of 2,500,000 m2 of floors). Social housing, low-price housing, from 25 million VND / m2 or less is in deficit, especially in provinces and cities of class I.

Businesses that invest in projects should restructure their products, because the market for low-cost housing is still very large. The real estate market in 2020 will continue to face the problem of high demand but little supply if there is no solution to review the law.

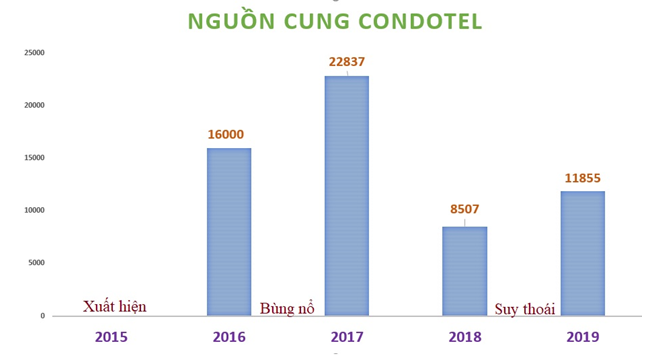

Construction of office buildings, resort real estate market in 2019 recorded a few new projects, reduced transactions, and increased inventories. In particular, the strong deceleration of the condotel, which has been “storming” before, made the market continue into a deep color. In 2019, the report on the slowdown in tourism growth has raised concerns about resort real estate when the segment is saturated.

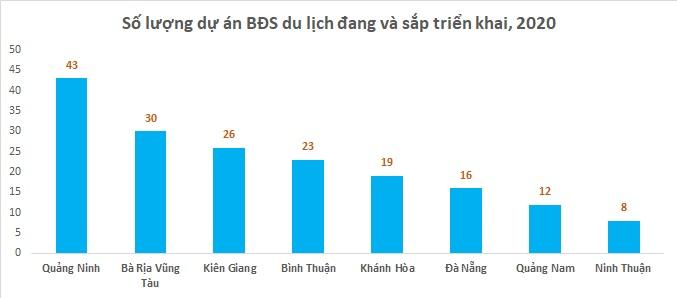

The highlight of the resort real estate market is coming from the “offshore fishing” strategy of real estate businesses. New lands such as Binh Thuan, Ninh Thuan, Phu Yen, Vung Tau, Quang Binh, Quy Nhon and Quang Ninh … have gradually changed their infrastructure, becoming a promising tourist destination. This is considered a driving force for the tourism real estate market in 2020.

2.Industrial Construction

2019 is also the year to witness a strong explosion of industrial construction, including industrial land, ready-built factories, warehouses and logistics.

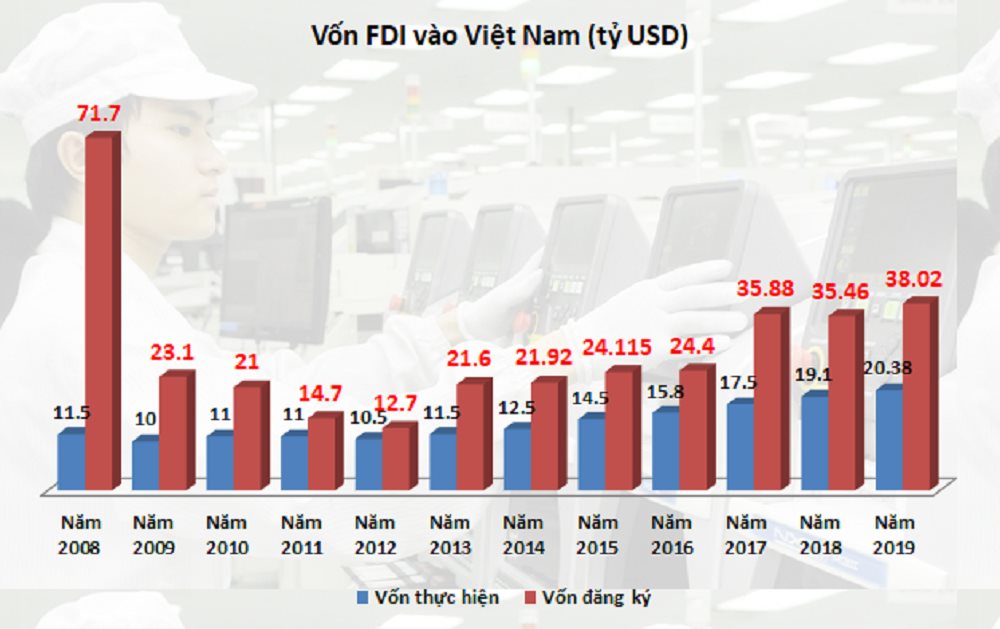

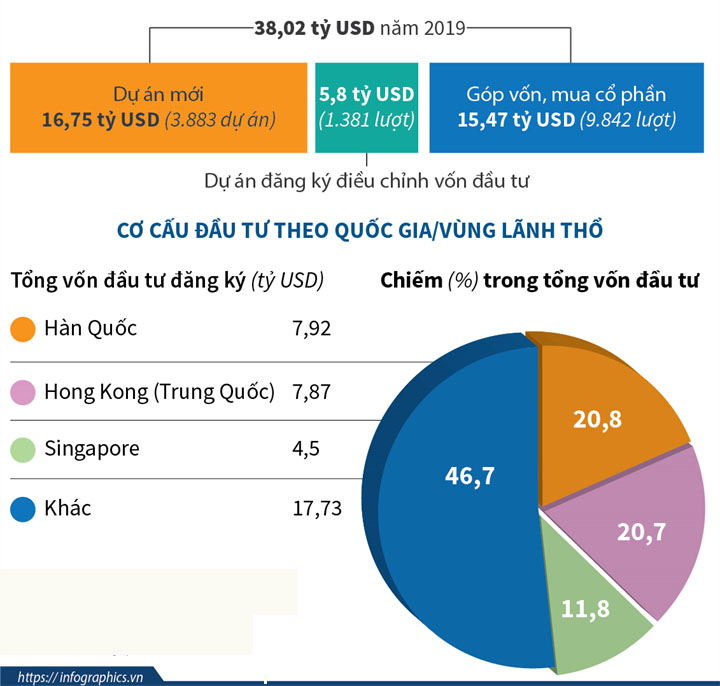

In the context of the narrowing of inner city land fund, the competition in housing projects is getting fiercer, while Vietnam has the potential to become a new industrial center of Southeast Asia. The segment of industrial construction grew strongly because it was supported by 2 factors: stable FDI and production wave into Vietnam in the context of US-China trade war.

By December 20, 2019, the total newly registered capital, adjusted and contributed capital to purchase shares of foreign investors in Vietnam reached US $ 38.02 billion, up 7.2% over the same period last year, 2018.

Previously, Savills Vietnam published a special report on industrial real estate in the first months of 2019 and gave a positive assessment for the potential new development cycle of this market. The report also suggests that Vietnam’s industrial construction is entering its golden age and has become a magnet for investors’ attention over the past 6 – 12 months.

Mr. Troy Griffiths, Deputy General Director of Savills Vietnam, commented: “The future of the industrial construction market lies in moving up the value chain, towards high value industries or industries in the region. sector 3 – the service industry. With that trend, let us pay attention to Da Nang: This market seems to be “overslept” but now has all the prerequisites for developing high-value industrial real estate. “

3.Infrastructure construction

The trend of urbanization is taking place strongly, in 2019, the construction of transport infrastructure projects maintains strong momentum and will continue to increase in the next 10 years. Increasing public investment will spur growth, domestic demand, domestic demand and booming construction.

At the same time, the Vietnamese government also prioritizes public investment in infrastructure, high-speed construction projects, elevated roads, bridges, petrochemical refineries, industrial parks to attract more houses foreign investors.

According to BMI research, Vietnam is one of the fastest growing marginal market, in which infrastructure investment is always considered a top priority of the Government. Statistics show that the cost of capital construction accounts for about 25% of total Government expenditure from 2015 – 2018. The State Bank is expected to cut 25% of the refinancing rate to 25%. 5.75%. USD / VND exchange rate by the end of 2020 will be around VND 23,000 / USD.

Statistics show that the cost of capital construction accounts for about 25% of total Government expenditure from 2015-2018.

In 2020, the Ministry of Finance said it would continue to focus on improving the business investment environment; create favorable conditions for businesses to develop, promote high and sustainable growth, create a stable budget revenue.

4. Construction Material

The market of construction materials in 2019 is a picture containing many bright as well as dark areas, the production and consumption of construction materials products have mostly leveled off. At the same time, the competition of the entire construction material industry is tougher than in previous years.

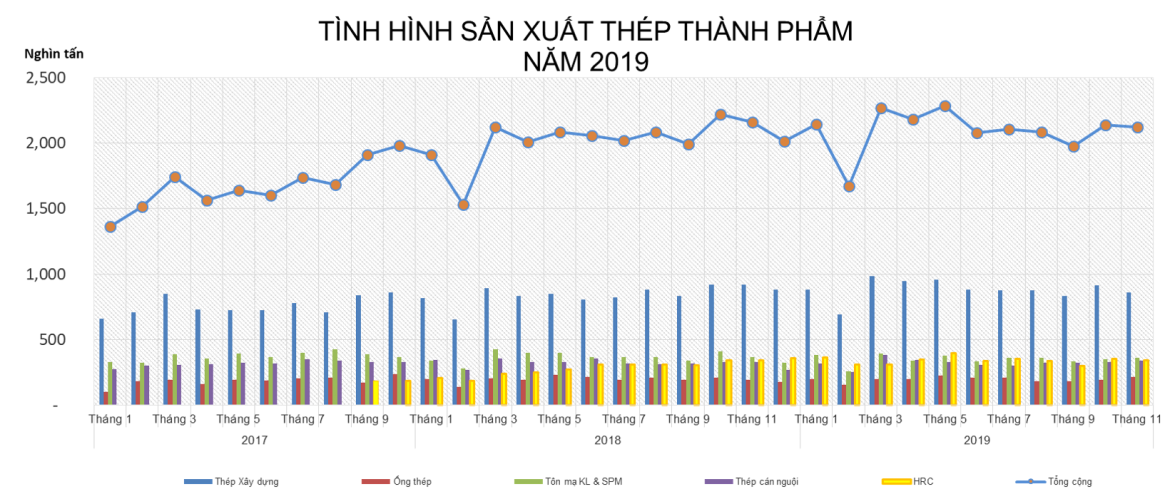

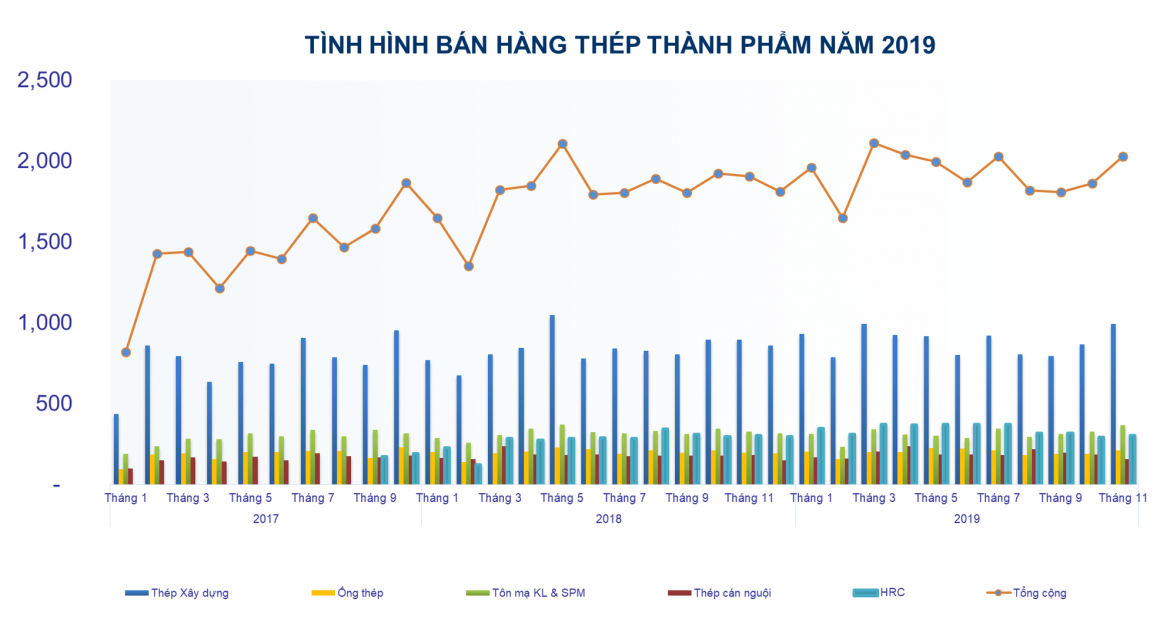

Domestic steel industry grew slowly. The reason is judged by the decline in global demand and price trends by China’s economy – a market that consumes 50% of total steel worldwide declines due to trade wars and economic cycle factors. The other reason is due to competitive pressure from increasing domestic supply and foreign steel imports.

In 2020, Vietnam’s steel industry will continue to face many difficulties and challenges in stemming from a number of reasons such as an increasing supply surplus in the country; The influence of international trade and protectionist policies continues to increase not only in the US market but also in many other countries. Growth in sales volume of the industry is expected to continue at a low rate of 5-7% in 2020 due to the slowdown in real estate market along with slow public investment. However, the increase in disbursement of FDI may be a supporting factor for steel demand.

Meanwhile, only cement products still saw growth. According to the Vietnam Cement Association as well as the Ministry of Construction, the whole industry consumed about 98 million tons of cement, reached the plan and increased 3 million tons compared to the same period in 2018. Report of the Import and Export Department (Ministry of Industry and Trade), in 2019, cement and clinker exports reached approximately 34 million tons, worth 1.394 billion USD, an increase of more than 148 million USD compared to 2018. Thus, the cement industry Vietnam’s cement industry has recorded a record export turnover for 2 consecutive years, continuing in the TOP of billion-dollar export items.

In 2020, the Ministry of Construction forecasts cement demand will continue to increase at 4-5% compared to 2019, reaching about 101 – 103 million tons, of which, domestic cement consumption is about 69-70 million tons, exporting is about 32 – 34 million tons.

The year 2019 also shows that the trend of green and environmentally friendly building materials is on the rise, the state are encouraging the development of green buildings.

5.Construction enterprises

In the first 9 months of 2019, many construction enterprises and large contractors listed on the stock exchanges such as Coteccons (CTD) and Hoa Binh (HBC), FECON Joint Stock Company (FCN), LICOGI 14 Joint Stock Company (L14), JSC LICOGI 16 (LCG) … also recorded an increasing proportion of the industrial construction segment in the revenue structure. These companies have good growth in production and business activities, and have great development potential in the period of 2020-2022.

More specifically, recently the Ministry of Transport has decided to cancel the prequalification in the form of opened international bidding and adjust the prequalification documents to suit the form of wide bidding within the country, selecting investors to carry out 8 PPP projects under the North-South Eastern Expressway Project.

In the context that Vietnam increased public investment to develop infrastructure, combining bidding to use domestic contractors. Vietnam’s leading construction and construction consultants will most likely benefit from the new context.

HIGHLIGHT EVENTS

Vietnam, from a market of only 335 hectares of land dedicated to industrial production in 1986, by 2018, this figure reached more than 80,000 hectares. With an open economic orientation, free trade agreements, and key economic regions established, Vietnam is a “magnet” to attract foreign investment.

The context of the tense US-China trade war has led researchers to believe that Vietnam will greatly benefit from manufacturers moving their supply chains from China to lower-cost Southeast Asian countries. In this competition, Vietnam has many advantages compared to other countries in the region. In the future, Vietnam’s industrial construction will have more opportunities to breakthrough and we will become a strategic destination, a new “factory” for international manufacturers.

At the end of November 2019, the event of Thanh Do Construction and Development Investment Joint Stock Company – the investor of Cocobay Da Nang project announced the end of payment of committed profit of 12% under the sales contract due to financial difficulties. It has created a quite strong “shaking” in the resort real estate market in general and the condotel market in particular.

The deal has raised doubts and debates about the domino breakdown in the resort real estate market in the context that this market is facing inventory and saturation.

However, silently after this event, there are still many resort real estate projects under construction. This incident is considered a “curve” for construction and development investors, because after the overheating development period, it is time for the condotel segment to be recognized with its right nature. Investors should gradually shift to building types of villas, villas, shophouse, resorts, resorts combined with entertainment to retain customers. In general, the market of resort real estate still has great potential.

Vietnam has also identified smart cities as an indispensable requirement of development during the Industrial Revolution 4.0. In August 2018, the Prime Minister approved the Scheme on the sustainable development of smart cities in Vietnam for the period of 2018 – 2025 and orientation to 2030. Accordingly, the goal of developing sustainable smart cities in Vietnam towards green growth, sustainable development, exploitation and promotion of potentials and advantages; improve the efficiency of resource use; optimally exploit resources and people effectively, improve the quality of life.

Following the trend of moving away from the crowded, overcrowded urban core, most current home buyers accept to move further, choosing to live in new urban areas that are far from the center but have a scale of hundreds of ha, with regional stature, full infrastructure and utilities.

Catching up with this trend, leading construction development investors were soon “ahead of the curve”, spending heavily on super-scale and multi-utility super projects. From the end of 2018 to 2019, the domestic market witnessed the presence of a series of mega-urban projects with huge scale, integrating many utilities and typical styles. These include the City of the lake (Vinhomes Ocean Park); Vinhomes Smart City – Smart City, a pioneer in hi-tech applications with 4 core axes: smart security, smart operation, smart community, smart apartments; Vinhomes Grand Park – City smart park.

The Government has just issued Decree No. 96/2019 / ND-CP on the land price bracket applicable for the period of 2020-2024, with a general increase of 20%. This price bracket is used as a basis for the People’s Committee of the province or city directly under the Central Government to elaborate and adjust the land price list in localities.

Accordingly, the applicable price bracket for Ho Chi Minh City and the Southeast provinces is the highest 162 million VND / m2, the lowest is 120,000 VND / m2.

In early December 2019, the Department of Natural Resources and Environment of Ho Chi Minh City submitted to Ho Chi Minh City People’s Committee two options for the new land price list in the city area from 2020 to 2024. The first plan with highiest land prices, twice as much as the present price (about 330 million VND / m2) and the second option is not to increase land prices.

Ho Chi Minh City People’s Committee has chosen the plan to maintain the current land price list, supplementing the land price of some new roads with a maximum of 162 million VND / m2. This is considered a positive move, preventing any negative impacts on the real estate market, people and businesses.

In Hanoi, the City People’s Council has recently approved an increase in the land price list in the period of 2020-2024, with an average increase of 15% compared to the previous 5-year period.

With this increase, after 2022, each household in Hanoi will pay higher non-agricultural land use tax of VND 45,000 / year. The total amount of taxes collected from the State increased by VND 57 billion.

After two typical low notes, including the “trick” of Alibaba and the “Cocobay” deal, Vietnam real estate market in 2019 showed the uncertainty about the stage of project approval.

Therefore, after the intense period, statistics on the areas, especially large markets, showed that the number of new projects is very small, the supply of apartments hit the bottom in 4 years. Specifically, according to the HCMC Real Estate Association, as of September 2019, Ho Chi Minh City market continued the downward trend, only one housing project was approved for investment policy, decreased by 83%; No housing project investor has been recognized; only 12 projects were approved for investment, a decrease of about 72% and only 24 projects were licensed for construction, a decrease of about 38%, compared to the same period in 2018. At the same time, there were only 32 future housing projects eligible for capital mobilization, with 19,662 houses, a decrease of 58.44% in the number of projects and a decrease of 30.56% in the number of houses compared to 2018.

In Hanoi, according to the Department of Construction’s announcement, in the first 6 months, there were 26 real estate projects in the city with the conditions to open for sale, with a total of more than 17,400 products, both apartments and low floor houses.

According to market research units such as Savills, CBRE, JLL, or Vietnam Real Estate Brokers Association, in the first 6 months of 2019, only 6 new projects in the apartment segment entered the Hanoi market. , the rest are mostly old projects that open for sale in the next installments, or sell the remaining bad ones.

Severe “bottlenecks” in approving project investment have affected housing supply and transactions. In the second quarter of 2019, the units recorded the lowest supply of apartments in both Hanoi and Ho Chi Minh City since 2014. By the third quarter, the supply improved but remained low compared to the same period in 2018.

The reasons indicated are due to problems and conflicts of some laws and law enforcement. In this context, many opinions expressed concern about the market picture in 2020 because the risk of supply reduction will make the market more and more quiet.

Houselink.com.vn